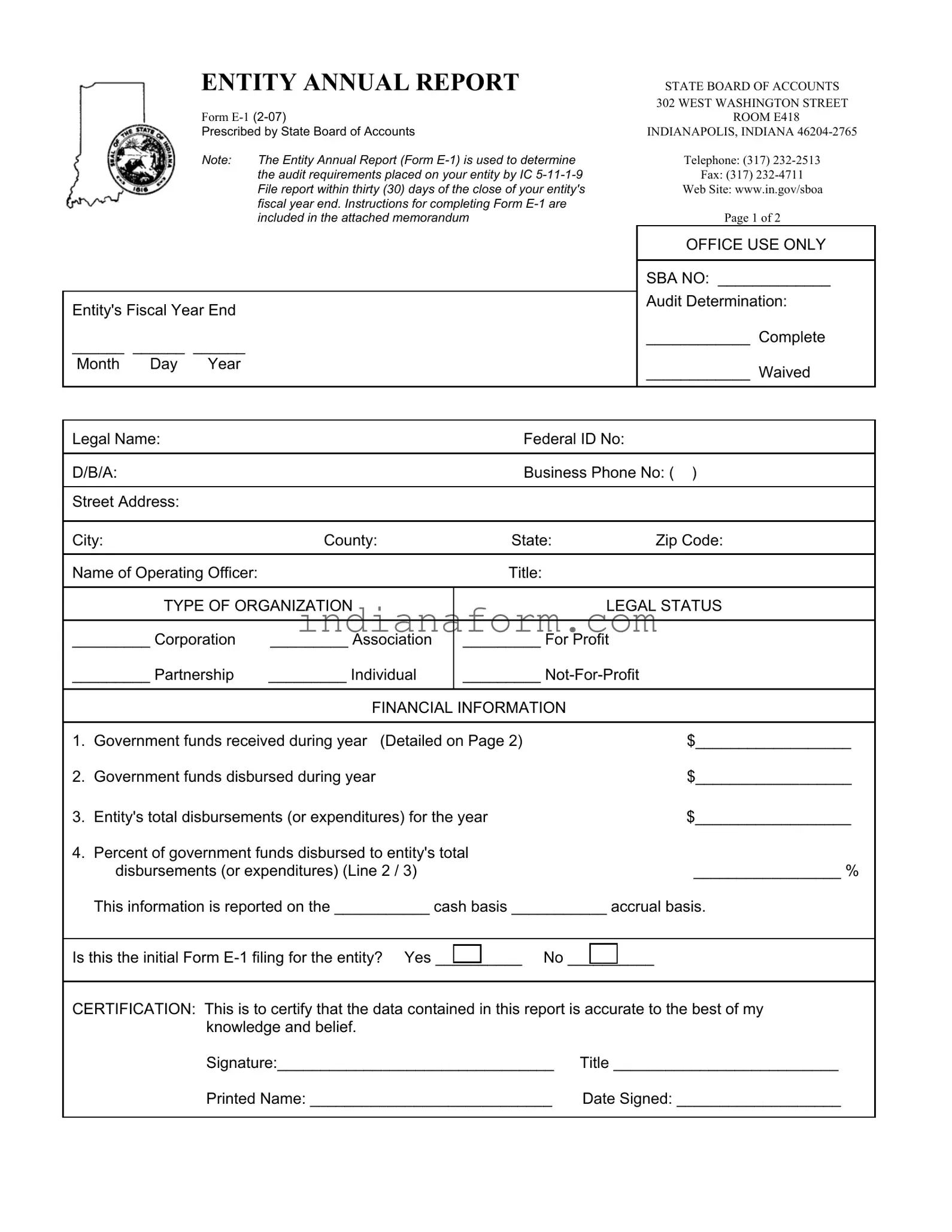

What is the Entity Annual Report in Indiana?

The Entity Annual Report, known as Form E-1, is a document required by the State Board of Accounts in Indiana. It collects financial information and other details about an entity to assess its audit requirements based on the Indiana Code IC 5-11-1-9. This report must be filed within thirty days following the end of the entity's fiscal year.

Who needs to file the Entity Annual Report (Form E-1)?

Any entity, including corporations, partnerships, associations, and not-for-profit organizations, operating within Indiana and receiving government funds is required to file this report. It is essential for the determination of the entity's audit requirements by the State Board of Accounts.

What information is required on Form E-1?

The form requires detailed information about the entity such as the legal name, type of organization, federal ID number, business phone number, and contact information of the operating officer. It also demands a financial summary of the government funds received and disbursed within the year, plus the entity's total disbursements. Further details on the government funds received must be specified, and the entity is asked about its foundation, purpose, governing structure, and any previous audits by an Independent Public Accountant (IPA).

What is the deadline for filing the Entity Annual Report in Indiana?

The deadline for filing the Entity Annual Report (Form E-1) with the Indiana State Board of Accounts is within thirty days after the close of the entity's fiscal year end. It's crucial to adhere to this timeframe to ensure compliance and avoid any potential issues regarding audit requirements.

Can the Entity Annual Report be submitted electronically?

The document does not specify the acceptable methods for submission directly. However, entities interested in submitting the Entity Annual Report should contact the State Board of Accounts directly, either through their website at www.in.gov/sboa or by phone at (317) 232-2513, to inquire about current submission methods, which may include electronic filing.

What happens if an entity fails to file Form E-1 on time?

If an entity does not submit Form E-1 within the designated period, it may face challenges with the State Board of Accounts regarding its financial accountability and audit requirements. Entities are encouraged to file on time to ensure their operations remain in good standing and to avoid any inconvenience or potential scrutiny.

Is assistance available for completing the Entity Annual Report?

Yes, assistance for completing Form E-1 is available. Detailed instructions are attached to the form itself. Additionally, entities can seek help or clarification from the State Board of Accounts by reaching out via their contact information provided on the form. They offer guidance through their website or direct communication over the phone.

Does filing the Entity Annual Report replace the need for an independent audit?

No, filing Form E-1 does not replace the need for an independent audit. The purpose of this report is to help determine an entity's audit requirements. Based on the information provided in Form E-1, an entity may still be required to undergo an audit by an Independent Public Accountant, depending on specific criteria set by the Indiana State Board of Accounts.

What is the significance of the audit determination on Form E-1?

The audit determination section on Form E-1 indicates whether the State Board of Accounts has decided that a complete audit is required for the entity, or if the audit requirement has been waived for the reported fiscal year. This decision is influenced by the financial data and other information provided in the report.

Where can I find more information about the Entity Annual Report and other requirements?

For more information about the Entity Annual Report (Form E-1) and other related requirements, visit the Indiana State Board of Accounts website at www.in.gov/sboa. Here, entities can access resources, guidance documents, and contact information for further assistance. Additionally, contacting the Board directly through phone or electronic communication is encouraged for specific queries or concerns.