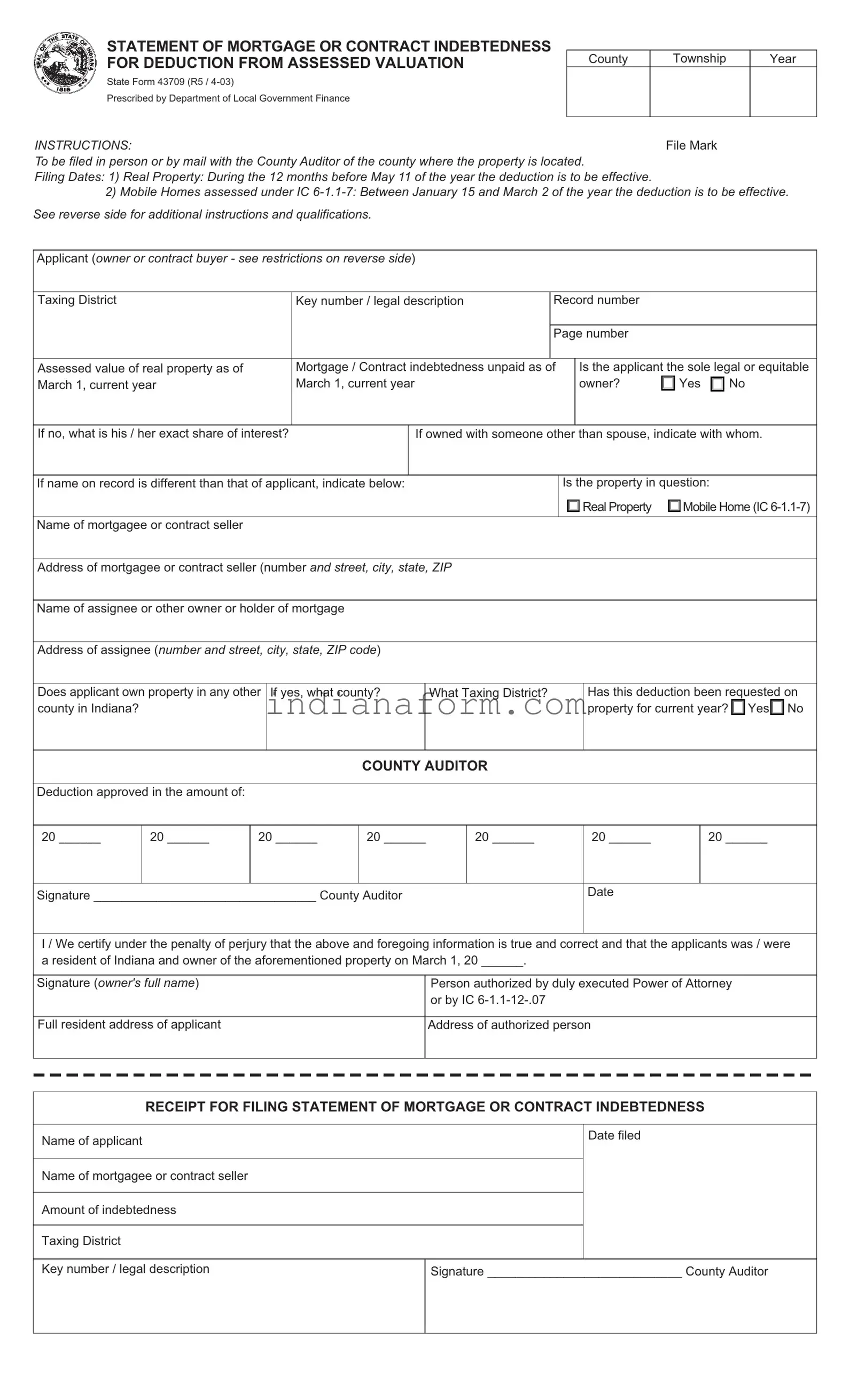

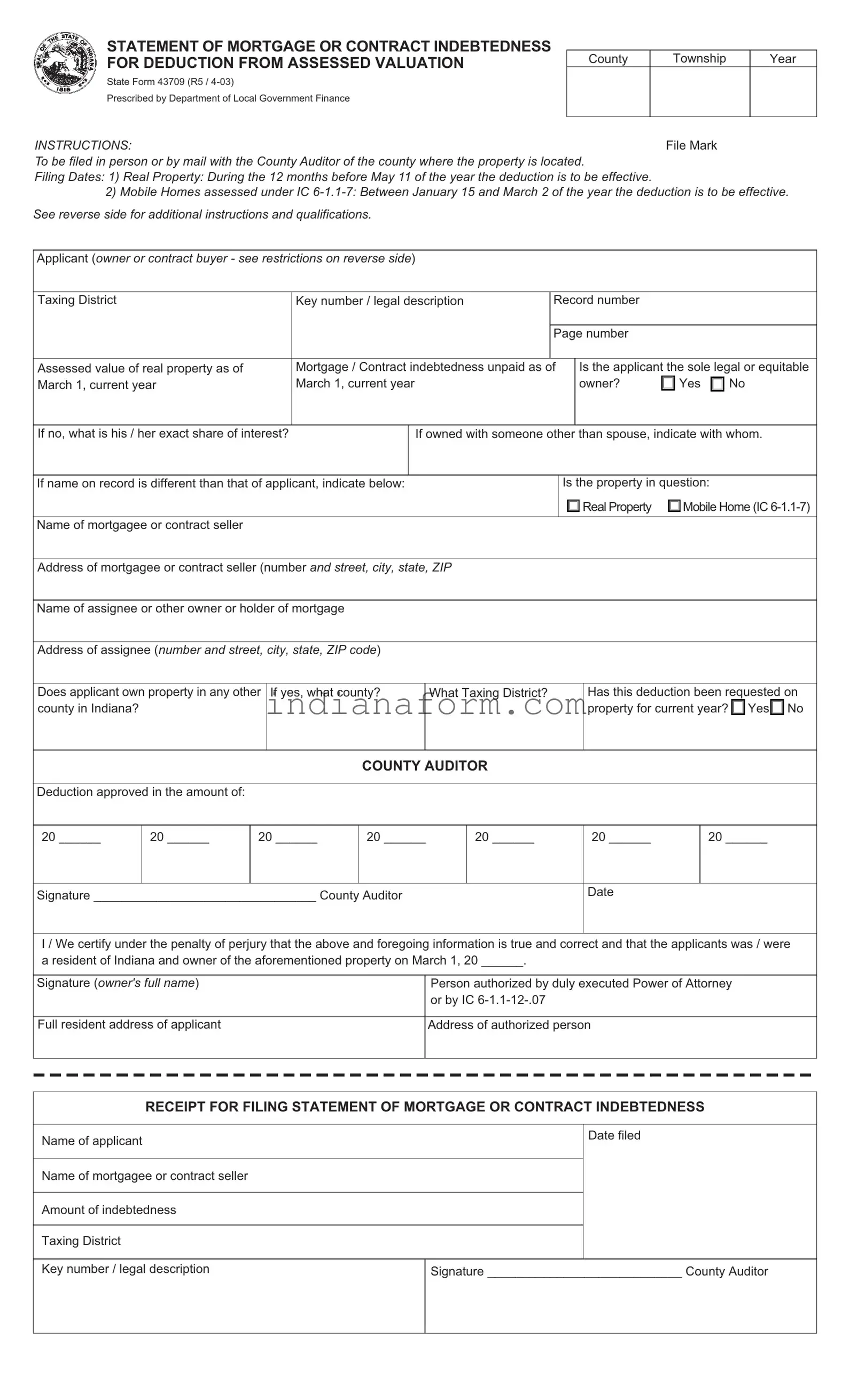

File Mark

STATEMENT OF MORTGAGE OR CONTRACT INDEBTEDNESS FOR DEDUCTION FROM ASSESSED VALUATION

State Form 43709 (R5 / 4-03)

Prescribed by Department of Local Government Finance

INSTRUCTIONS:

To be filed in person or by mail with the County Auditor of the county where the property is located.

Filing Dates: 1) Real Property: During the 12 months before May 11 of the year the deduction is to be effective.

2)Mobile Homes assessed under IC 6-1.1-7: Between January 15 and March 2 of the year the deduction is to be effective. See reverse side for additional instructions and qualifications.

Applicant (owner or contract buyer - see restrictions on reverse side)

Taxing District |

Key number / legal description |

Record number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page number |

|

|

|

|

|

|

|

|

|

|

Assessed value of real property as of |

Mortgage / Contract indebtedness unpaid as of |

Is the applicant the sole legal or equitable |

March 1, current year |

March 1, current year |

|

owner? |

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

If no, what is his / her exact share of interest?

If owned with someone other than spouse, indicate with whom.

If name on record is different than that of applicant, indicate below: |

Is the property in question: |

|

|

|

Real Property |

|

Mobile Home (IC 6-1.1-7) |

|

|

|

|

|

|

|

|

|

|

Name of mortgagee or contract seller |

|

|

|

|

|

Address of mortgagee or contract seller (number and street, city, state, ZIP

Name of assignee or other owner or holder of mortgage

Address of assignee (number and street, city, state, ZIP code)

Does applicant own property in any other county in Indiana?

COUNTY AUDITOR

Deduction approved in the amount of:

Signature ________________________________ County Auditor

I / We certify under the penalty of perjury that the above and foregoing information is true and correct and that the applicants was / were a resident of Indiana and owner of the aforementioned property on March 1, 20 ______.

Signature (owner's full name) |

Person authorized by duly executed Power of Attorney |

|

or by IC 6-1.1-12-.07 |

|

|

Full resident address of applicant |

Address of authorized person |

|

|

RECEIPT FOR FILING STATEMENT OF MORTGAGE OR CONTRACT INDEBTEDNESS

Name of applicant |

Date filed |

|

Name of mortgagee or contract seller

Amount of indebtedness

Taxing District

Key number / legal description |

Signature ____________________________ County Auditor |

|

|

Instructions and Qualifications

Applicants must be residents of the State of Indiana.

Applications must be filed during the periods specified. Once the application is in effect, no other filing is necessary unless there is a change in the status of the property of applicant that would affect the deduction.

This application may be filed in person or by mail. If mailed, the mailing must be postmarked before the last day for filing.

Any person who willfully makes a false statement of the facts in applying for this deduction is guilty of the crime of perjury and on the conviction thereof will be punished in the manner provided by law.

The deduction equals $3,000, one-half of the assessed value of the property, or the balance of the mortgage or contract indebtedness as of the assessment date, which ever is least.

Authority for signing a deduction application may be delegated only by an executed power of attorney or by IC 6-1.1-12-.07.

Signature of only one spouse is required for filing, when owner is a husband and wife as tenants by the entireties.

An Indiana resident who was a member of the United States Armed Forces and who was away from the county of his residence as a result of military service during the time of filing must file a claim for deduction during the twelve months before May 11 of the year next succeeding the year of discharge.

A contract buyer must submit a recorded copy or recorded memorandum of the contract, which contains a legal description with the first statement filed for this deduction.

Yes

Yes

No

No