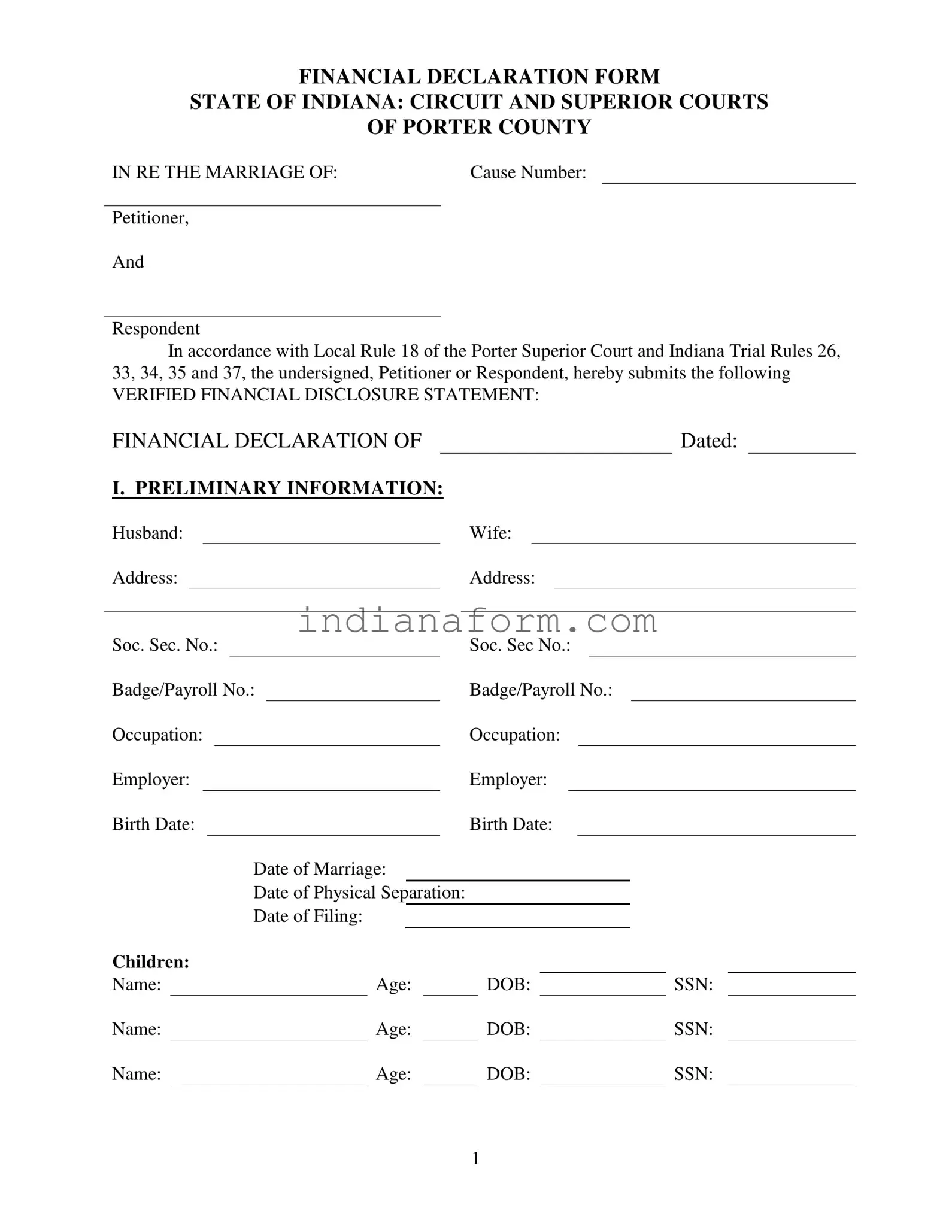

What is the purpose of the Indiana Financial Declaration form?

The Indiana Financial Declaration form serves a critical role in legal proceedings, particularly in matters of divorce, child support, and spousal maintenance. Its primary purpose is to provide a comprehensive overview of an individual's financial situation, detailing income, expenses, assets, and liabilities. This thorough financial snapshot aids the court in making informed decisions regarding financial obligations and entitlements among parties.

Who is required to complete the Indiana Financial Declaration form?

Any party involved in a legal case that pertains to financial support or the division of assets may be required to complete the Indiana Financial Declaration form. This includes individuals going through a divorce, seeking child support, or involved in disputes requiring financial judgment. Both parties, whether they are petitioners or respondents in a case, might need to provide this declaration to ensure equitable consideration of financial matters by the court.

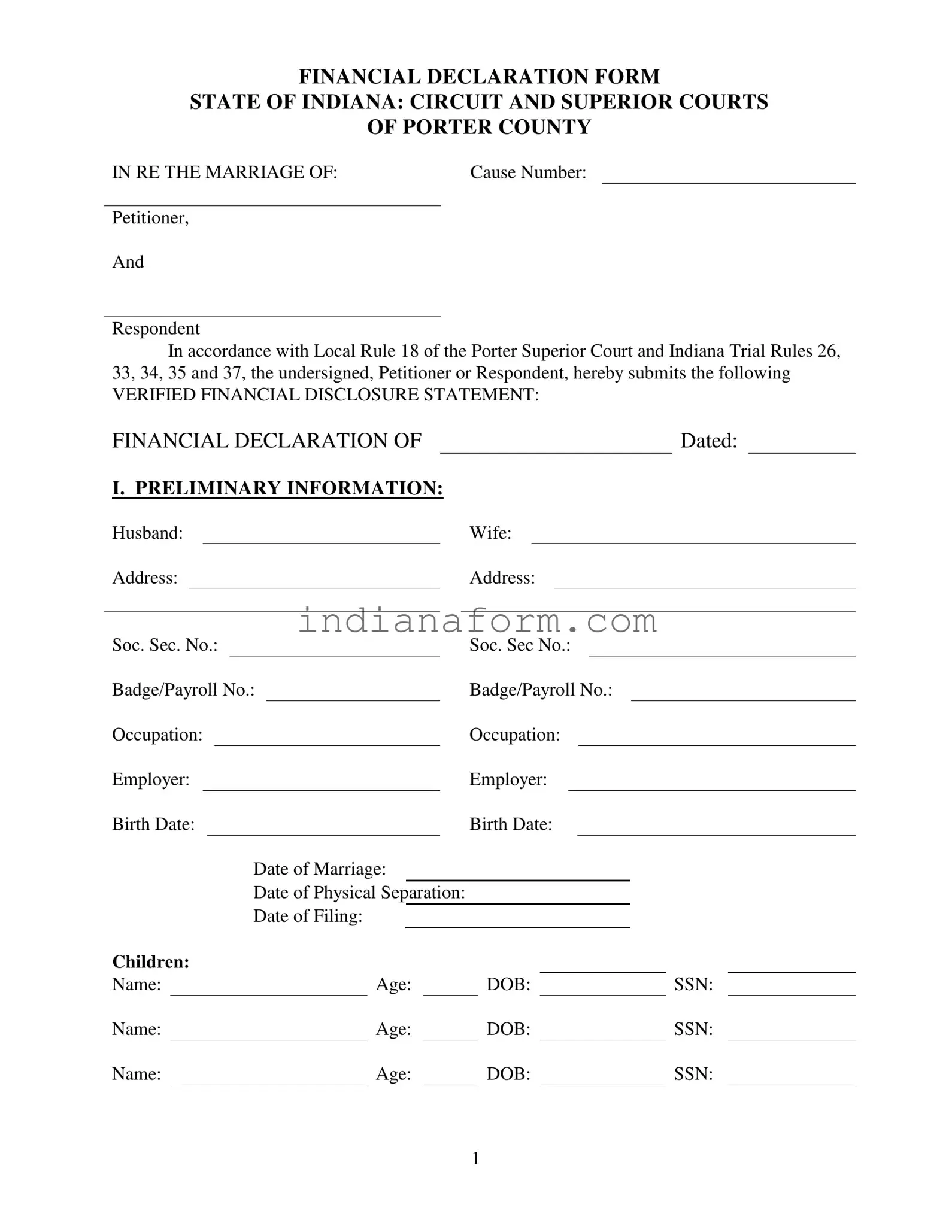

What information do you need to provide on this form?

The form requires detailed information about an individual's financial status. This includes current income from all sources, weekly expenses, assets (such as real estate, vehicles, and investments), and any liabilities or debts. Also required are details of any children from the marriage, monthly expenses, and deductions from income, such as taxes and insurance premiums. The goal is to paint a full picture of your financial capacity and responsibilities.

How often do you need to update the information on the form?

After the initial submission of the Indiana Financial Declaration form, you are under an obligation to update or amend the information if you learn that what you provided was incorrect or has changed significantly. This ensures that all decisions made by the court regarding financial matters are based on the most current and accurate data. It's important to keep the information updated, especially as your financial situation evolves or as your case progresses.

Is it necessary to attach documentation to the Financial Declaration form?

Yes, attaching documentation to support the information listed on your Financial Declaration form is essential. This may include your last three payroll stubs to verify income, calculations for rents or business income, and documentation for any other income or assets listed. Providing documentation helps verify the accuracy of the information provided and can be crucial for substantiating your financial position in court.

What happens if I knowingly provide false information on this form?

Providing false information on the Indiana Financial Declaration form can have serious legal repercussions. Since the form is completed under penalty of perjury, knowingly submitting false or misleading information could lead to charges of perjury. The consequences might include legal penalties, fines, or a reevaluation of your case, potentially impacting judgments on custody, support, or the distribution of assets.

Where do I submit my completed Financial Declaration form?

The completed Financial Declaration form should be filed with the court handling your case and also served upon the opposing party or their attorney, if applicable. This ensures that both the court and the opposing party are fully informed of your financial situation. Check with your attorney or the court clerk for specifics regarding the submission process, as it may vary slightly by county or jurisdiction within Indiana.