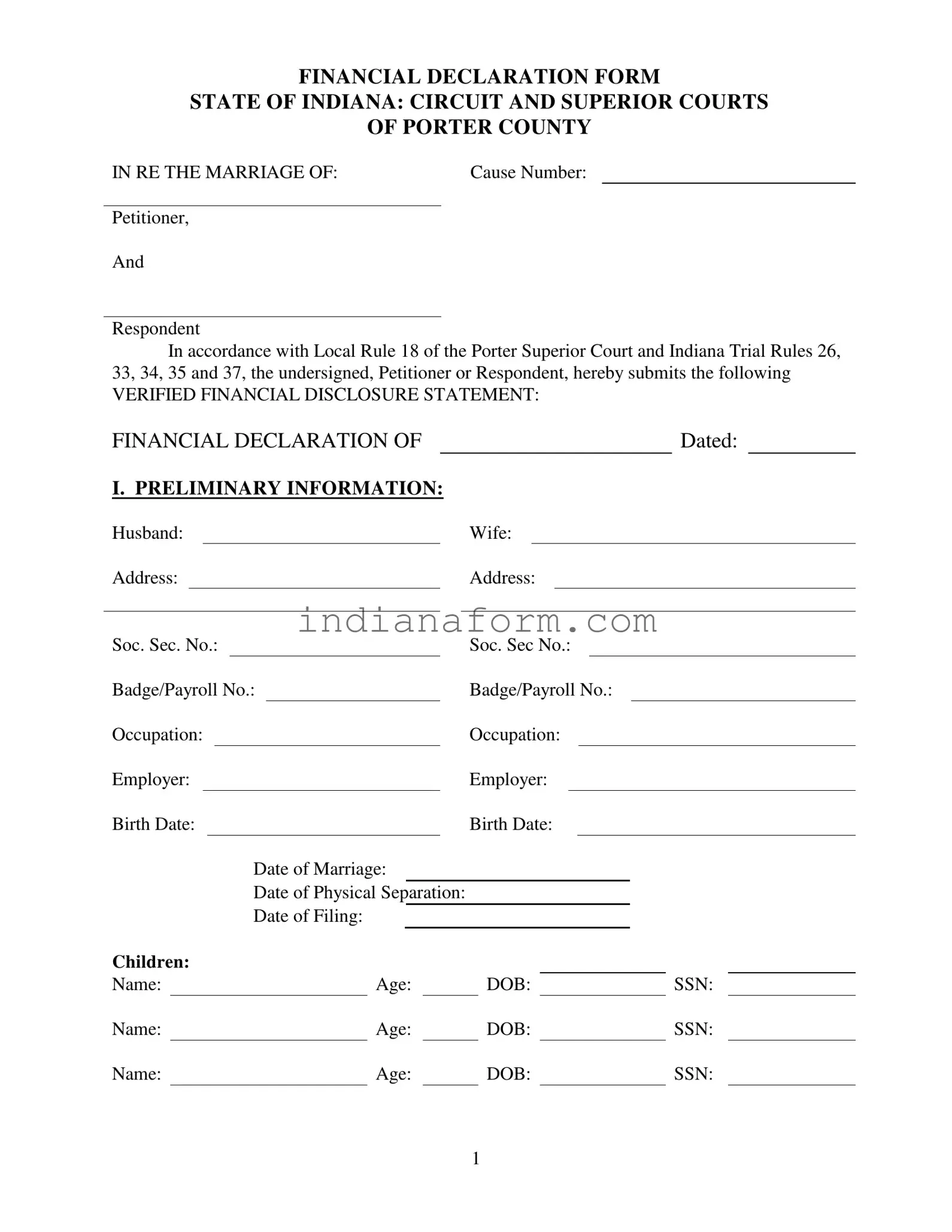

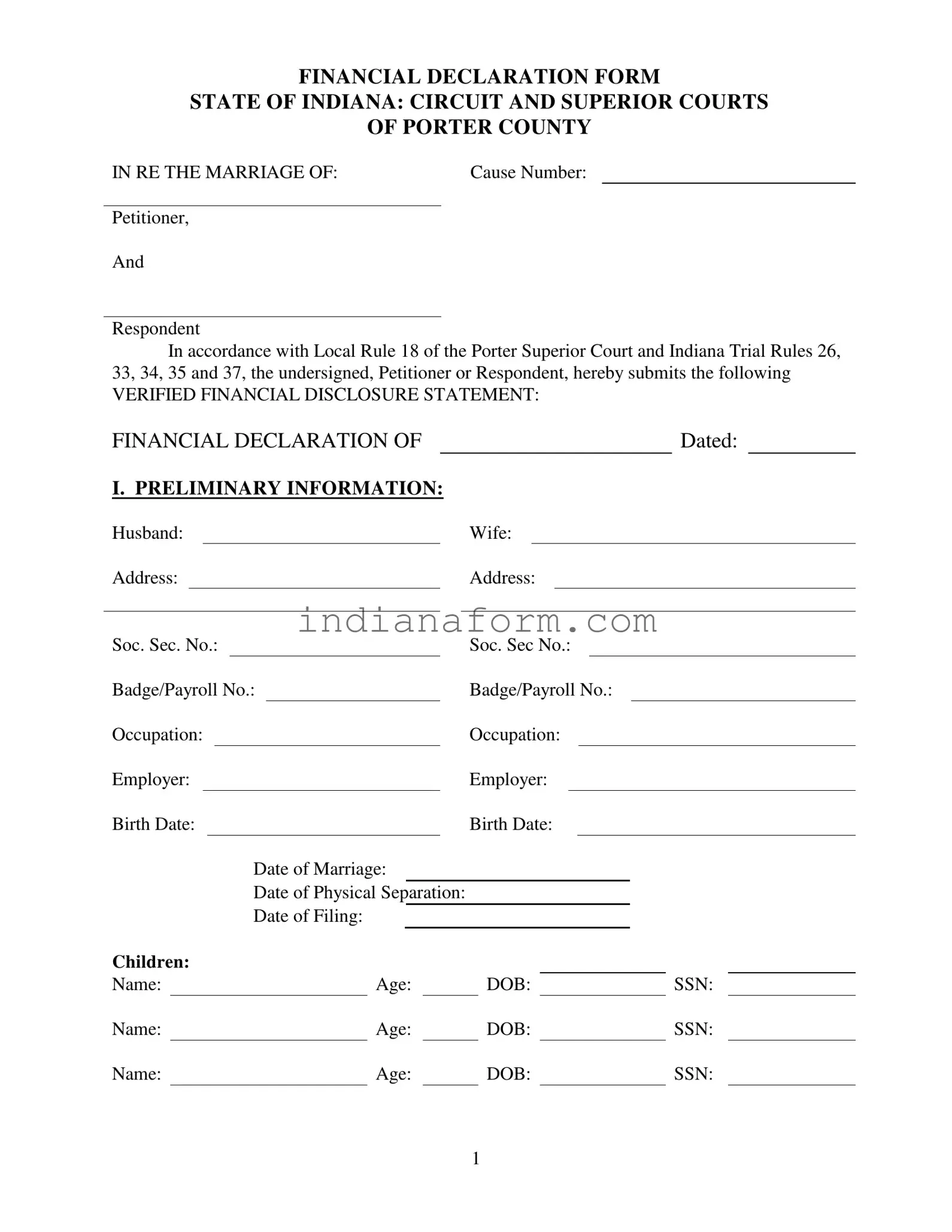

What is the purpose of the Indiana Financial Declaration Form?

The Indiana Financial Declaration Form is an official document used in legal proceedings, specifically within the realm of family law, to provide a comprehensive overview of an individual's financial situation. This form is crucial for cases involving divorce, child support, and spouscription. It helps the courts in Porter County make informed decisions regarding financial obligations and entitlements by detailing incomes, expenses, assets, and liabilities.

Who is required to fill out this form?

Either the petitioner or the respondent involved in a court case relating to marriage, such as a divorce or custody dispute, is required to complete the Indiana Financial Declaration Form. It is mandatory in cases where the financial distribution between parties needs to be ascertained or amended by the court, ensuring financial transparency and fairness in the proceedings.

What information needs to be included in this form?

The form requires detailed information about personal identification, employment and income, including salary, bonuses, pensions, and any other sources of income. Additionally, it requires disclosure of monthly living expenses such as housing, groceries, clothing, and healthcare costs. Itemization of deductions from income and details about any children, including their healthcare and educational needs, are also necessary. The purpose is to paint a full picture of the financial status of the individual.

How is income calculated if I am self-employed?

For self-employed individuals, gross weekly income is calculated based on the average income after business expenses. This calculation should consider the net profit from the business by subtracting total business expenses from gross receipts or revenues. The resulting figure should then be divided accordingly to report a weekly amount, ensuring an accurate representation of personal income derived from self-employment.

What happens if information on my Financial Declaration Form changes?

If there is a change in financial circumstances after submission of the Financial Declaration Form, it is important to promptly inform the court and submit an amended form. Changes could include variations in income, employment status, or monthly expenses. Timely updates ensure that the court's understanding of each party's financial situation is current, which can affect orders related to child support, alimony, and other financial settlements.

Is the information provided on the form kept confidential?

Information provided on the Indiana Financial Declaration Form is considered confidential to an extent but is accessible by both parties involved in the case and their attorneys. It is filed with the court, making it a part of the public record; however, sensitive information such as Social Security Numbers is protected and kept confidential from the public domain to prevent identity theft and maintain privacy.

How often do I need to update or re-submit this form?

The Indiana Financial Declaration Form needs to be updated and re-submitted whenever there is a significant change in financial circumstances, or as ordered by the court. Regular updates may not be necessary unless directed by a court order or legal requirement but staying proactive about changes ensures fairness and accuracy in the legal process concerning financial matters.