The Indiana NP-20 form is similar to several other documents that nonprofit organizations may encounter, particularly when they are handling their annual reporting and tax obligations. This form, designated for the Indiana Department of Revenue, encompasses aspects familiar to those who have dealt with federal nonprofit filings, state-level nonprofit reports, and unrelated business income reports. Each of these documents has its unique features, yet shares common purposes with the NP-20 form, such as ensuring compliance, providing transparency, and maintaining the nonprofit's status.

Federal Form 990, 990-EZ, or 990-PF

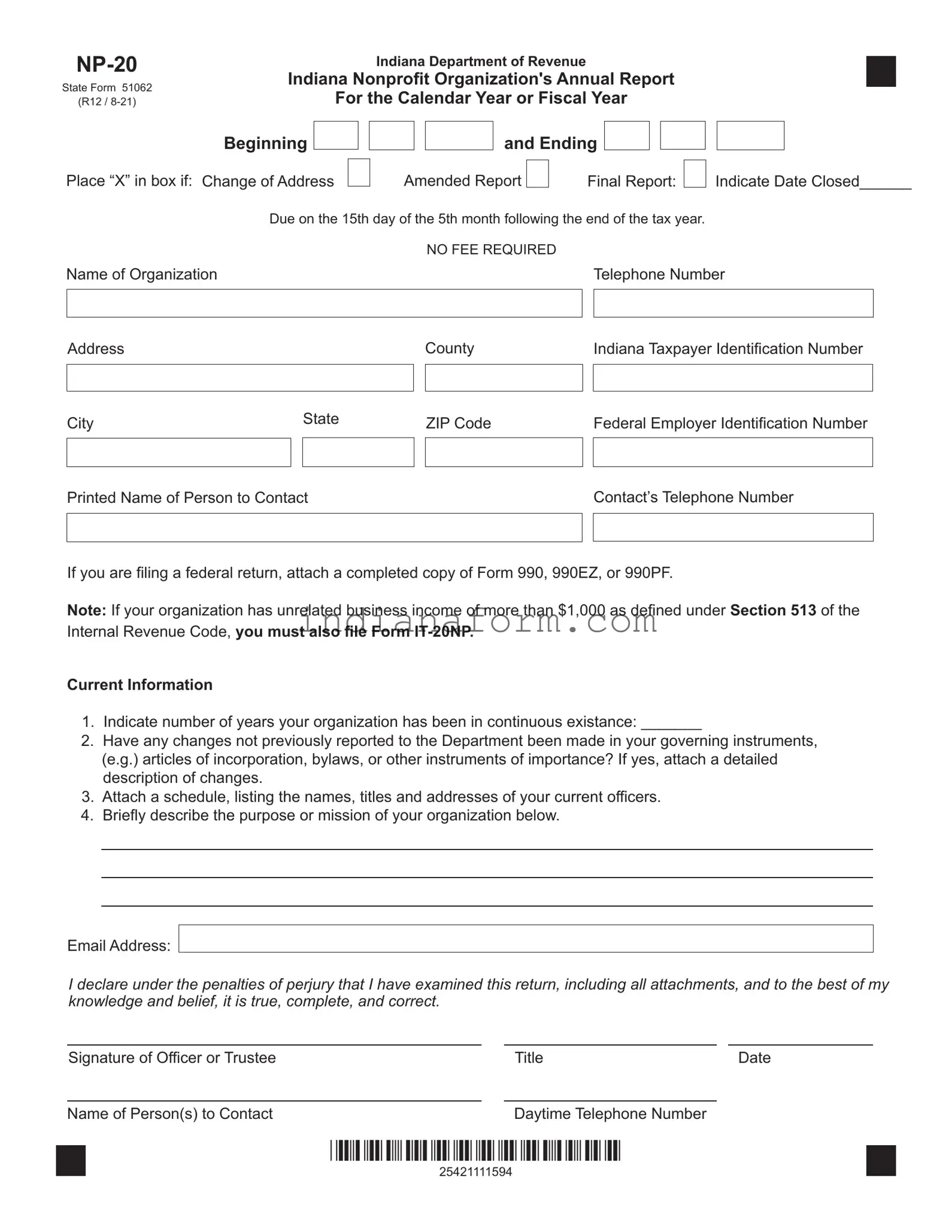

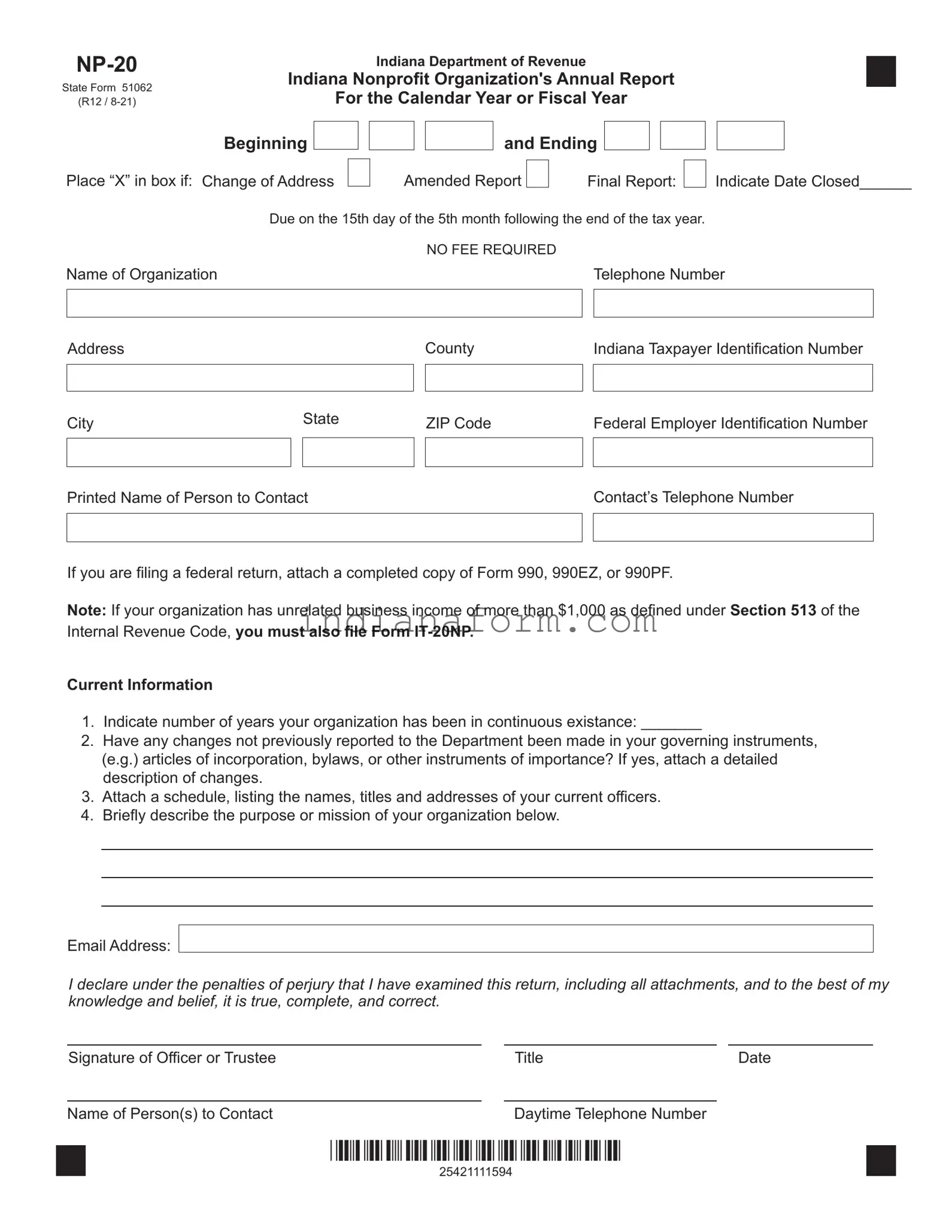

The Indiana NP-20 form is notably similar to the federal Form 990 series, which includes Form 990, 990-EZ, and 990-PF. These forms are required by the Internal Revenue Service (IRS) for most tax-exempt organizations to provide annual financial information. Like the NP-20 form, they serve to inform the government and the public about the nonprofit's operations, including revenue, expenditures, and activities aligned with its mission. The requirement to attach a completed copy of one of these forms when filing the NP-20 emphasizes the parallel in their purpose, which is to ensure accountability and transparency of nonprofit organizations. They both ask for detailed descriptions of the organization's activities, financial statements, and list of current officers, though the federal forms require more comprehensive financial details and can vary in complexity depending on the size and operations of the nonprofit.

State-Level Nonprofit Annual Reports

Many states require nonprofit organizations to file annual reports with a state agency, typically the Secretary of What's similar between these state-level reports and Indiana's NP-20 is their role in updating the state on the nonprofit's current status. This includes changes in address, amendments to the organizational documents, or updates in leadership—information that ensures the state has current data on the organization for regulatory and communication purposes. While the specifics of what’s included in these reports can vary from one state to another, the core goal is similar to the NP-20’s objectives: to maintain the nonprofit's good standing within the state, ensuring it operates in alignment with its declared mission and complies with state laws governing charitable organizations.

Form IT-20NP for Unrelated Business Income

Another document akin to the NP-20 is the Form IT-20NP, which is specific to Indiana nonprofits that have unrelated business taxable income exceeding $1,000. The IT-20NP form is used to report income that is not directly related to the organization's exempt purpose. This requirement mirrors a section of the NP-20 form which mandates reporting if the organization has received any unrelated business income, as defined under Section 513 of the Internal Revenue Code. Both forms are concerned with ensuring that nonprofits report and, where applicable, pay taxes on income not connected to their primary, tax-exempt functions. While they cater to different aspects of a nonprofit’s financial activities, the underlying principle is the preservation of the integrity and transparency of nonprofit operations within the state.