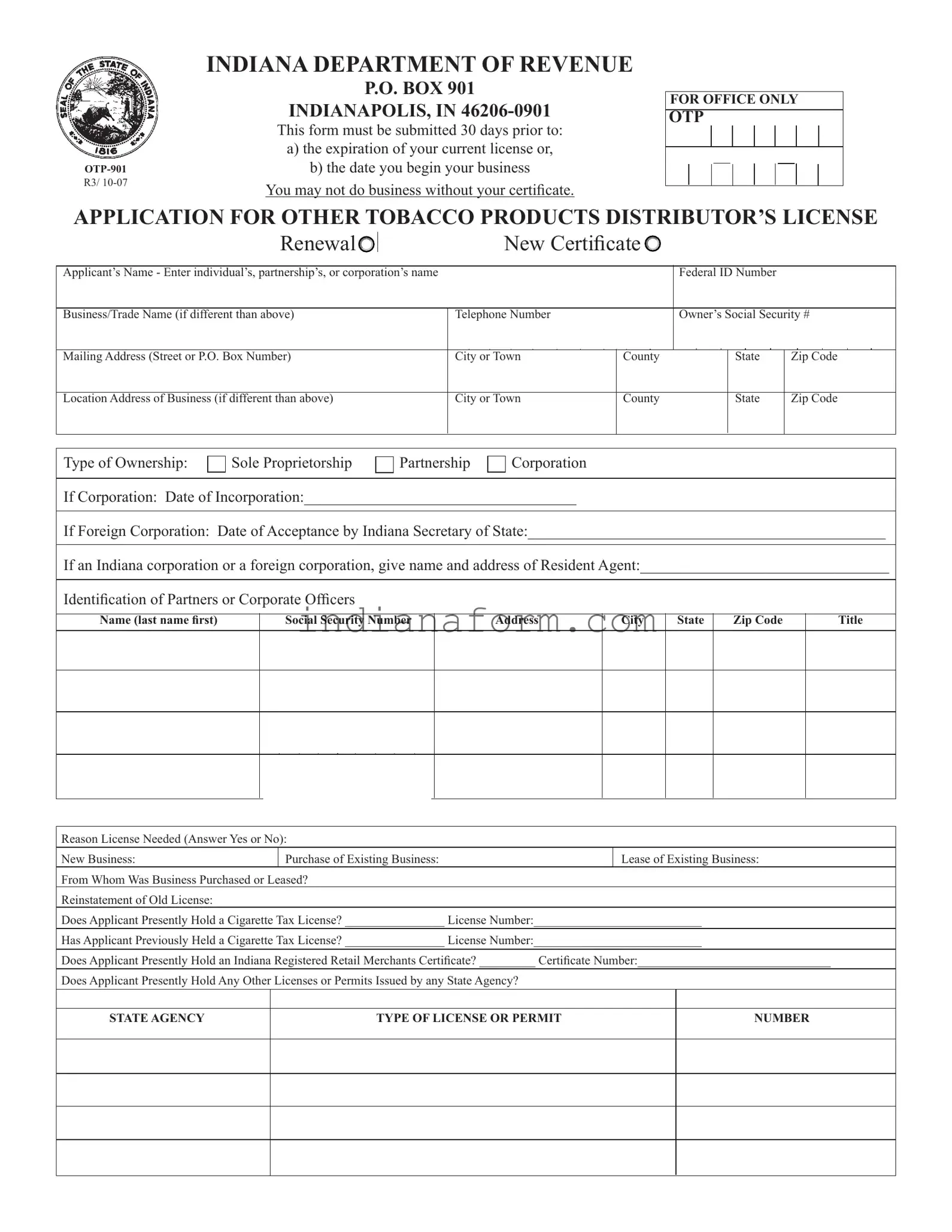

What is the Indiana OTP 901 form used for?

The Indiana OTP 901 form is utilized by businesses to apply for or renew an Other Tobacco Products Distributor's License with the Indiana Department of Revenue. This form is crucial for any entity planning to distribute tobacco products other than cigarettes within Indiana. It is required not only for new businesses but also for existing establishments that seek to continue their operations either through renewal or following changes such as new ownership or reinstatement of an old license.

When should the Indiana OTP 901 form be submitted?

Submission of the Indiana OTP 901 form must occur 30 days prior to the expiration of your current license or 30 days before you start your business. This preemptive submission ensures that the business can legally operate without interruption or delay due to licensing issues.

Can businesses operate without a certificate?

No, businesses cannot operate without a certificate. Operating a business involved in distributing other tobacco products without a valid license as sanctioned by the Indiana Department of Revenue is against state regulations. To avoid legal complications, it’s essential to secure the proper licensing before conducting any business activities.

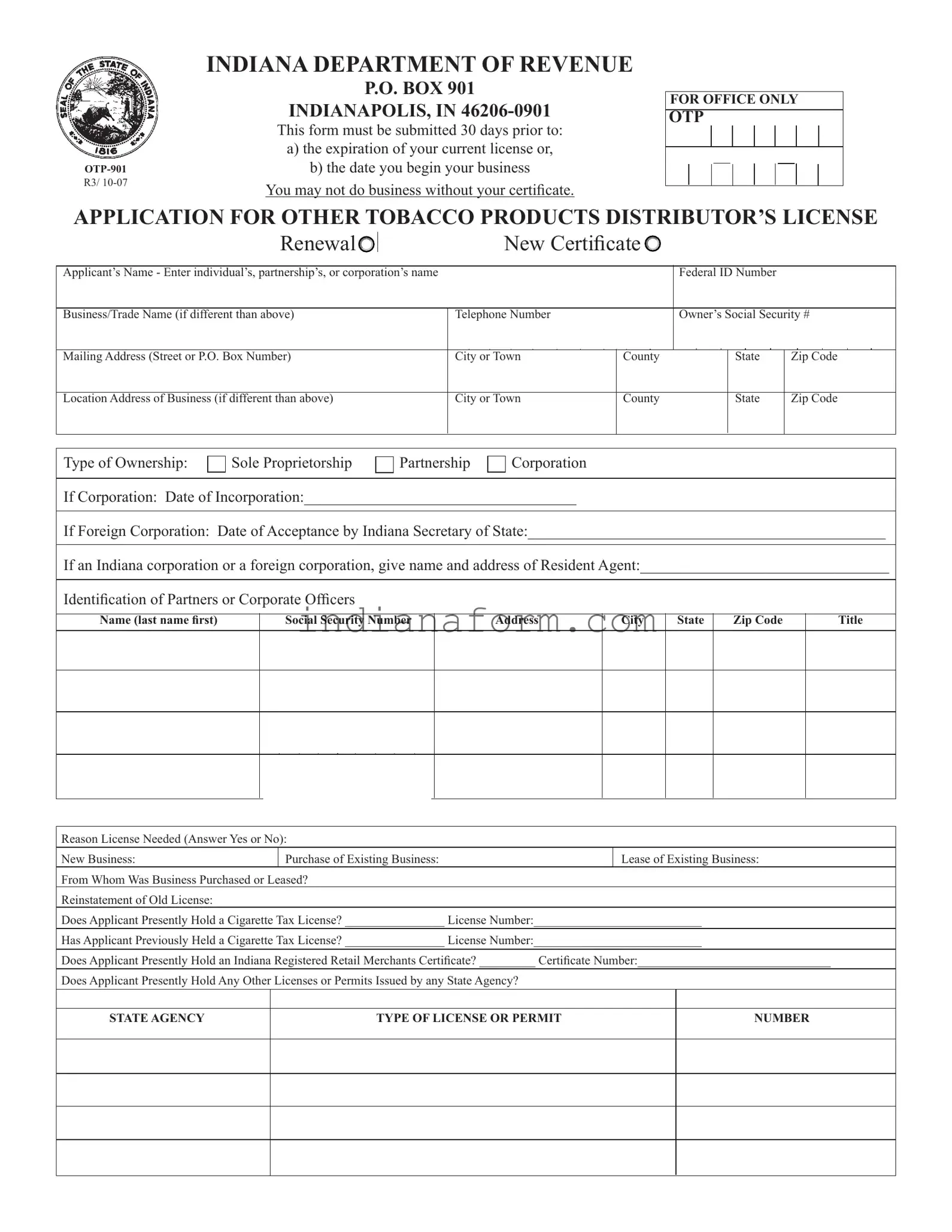

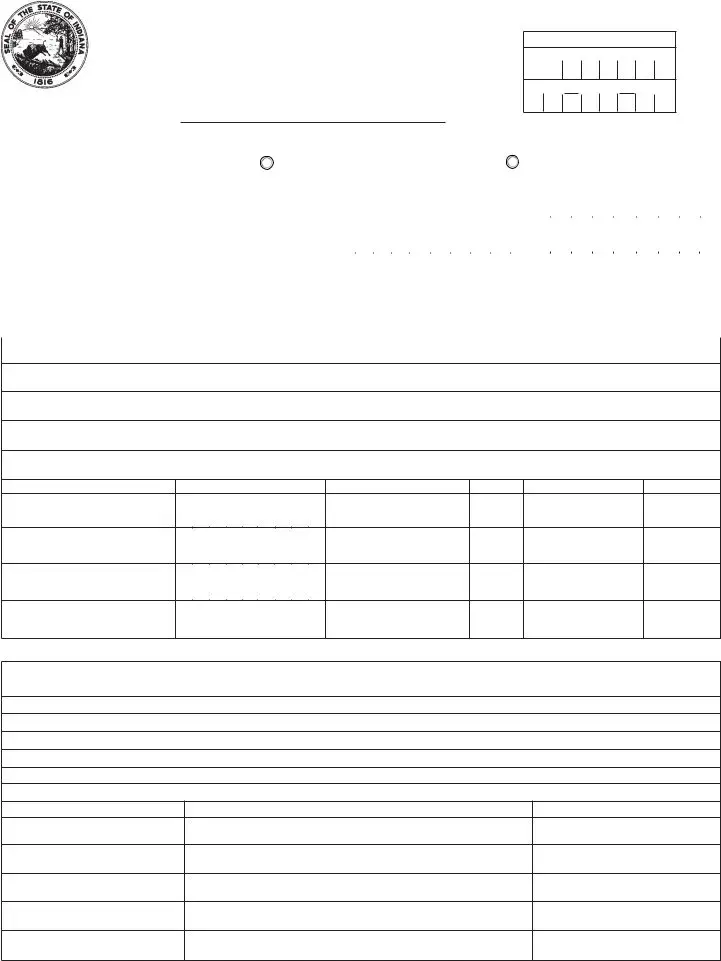

What information is required to complete the Indiana OTP 901 form?

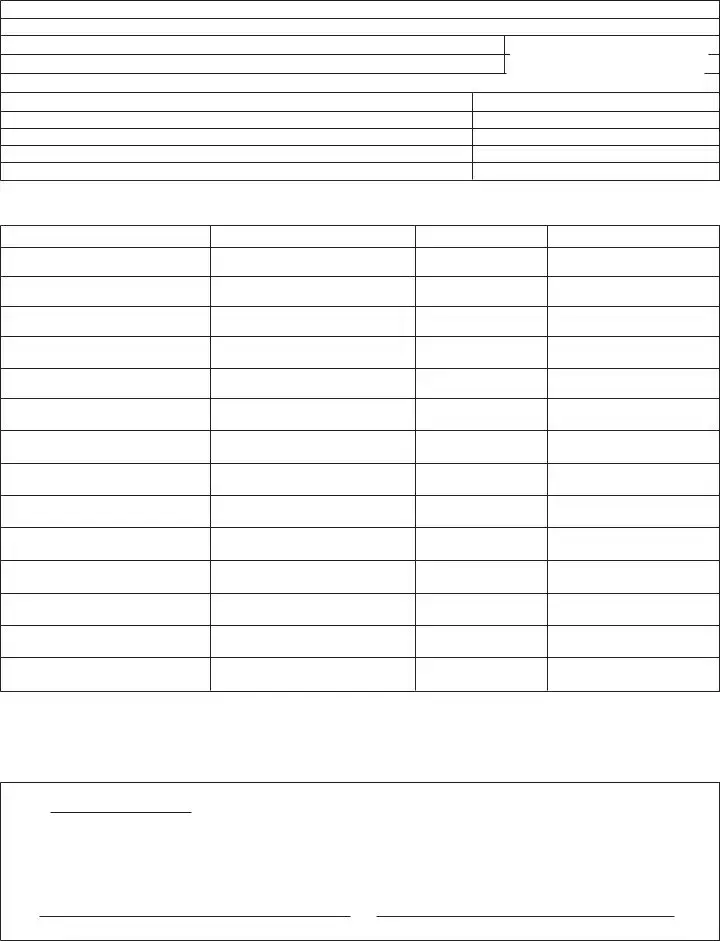

The form requires detailed information about the applicant, including the name of the individual, partnership, or corporation, Federal ID Number, business/trade name, telephone number, and social security number of the owner. Also needed are the mailing and location addresses of the business, type of ownership, identification of partners or corporate officers, and specific licensing questions related to the tobacco business and other state-issued permits or licenses. Additionally, applicants must provide information about their suppliers and whether they expect to sell tobacco products into another state.

What happens if the Indiana OTP 901 form is not submitted on time?

Failure to submit the Indiana OTP 901 form on time can lead to a disruption in the business's ability to legally sell other tobacco products within the state. This could result in penalties, including fines or a temporary halt of sales until the proper licensing is secured. Timely submission is crucial to maintain continuous legal operation.

How does an applicant declare the information on the Indiana OTP 901 form is true and accurate?

Upon completing the Indiana OTP 901 form, the applicant or authorized agent must sign the document, thereby declaring under penalties of perjury that the information provided is true, correct, and complete to the best of their knowledge and belief. This declaration emphasizes the importance of accuracy and legality in the application process.

Can the Indiana OTP 901 form cater to both new applications and renewals?

Yes, the Indiana OTP 901 form is designed to accommodate both new applicants seeking an Other Tobacco Products Distributor's License and existing licensees looking to renew their certification. The form carefully outlines sections that cater specifically to new businesses, purchases of existing businesses, lease of existing ones, reinstatements, and queries on previous cigarette tax licenses, ensuring a comprehensive platform for all types of applicants.