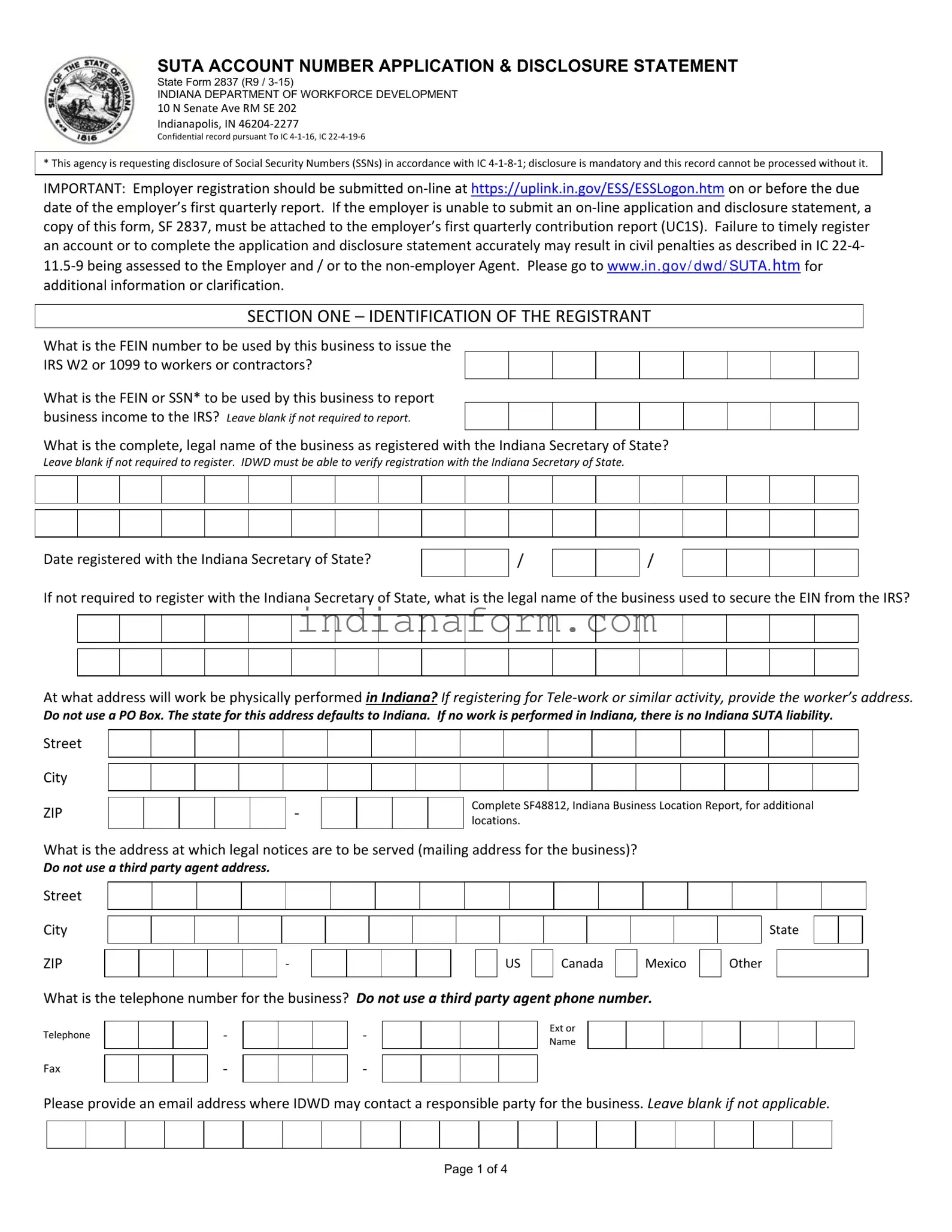

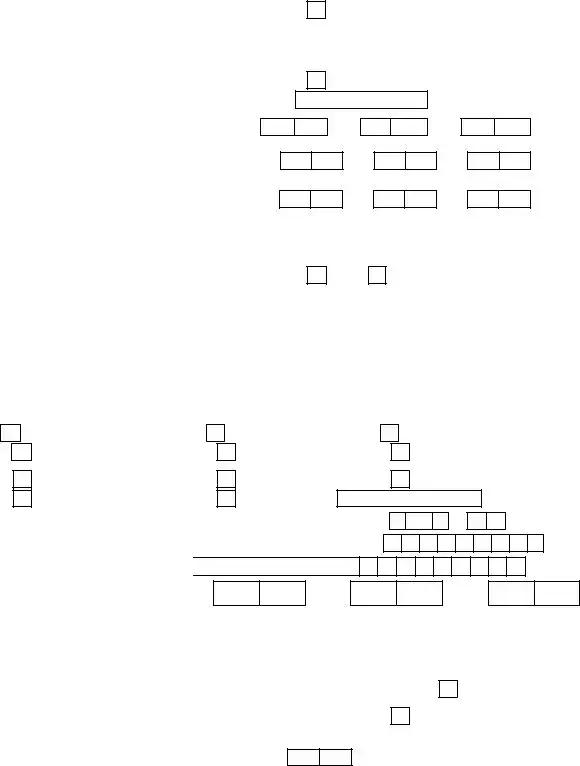

What is the Indiana SF 2837 form used for?

The Indiana SF 2837 form is an application and disclosure statement required by the Indiana Department of Workforce Development. It is used for the registration of businesses for Unemployment Insurance (UI) reporting and disclosing specific necessary information needed by the state. This form helps in determining the liability of a business under the State Unemployment Tax Act (SUTA).

Who needs to fill out the SF 2837 form?

Any business that operates within Indiana and meets certain criteria, like having employees, paying wages, or acquiring assets of another business, must complete SF 2837. This is essential for businesses that need to report and contribute to the unemployment insurance system in Indiana.

Can the SF 2837 form be submitted online?

Yes, employers are encouraged to submit their registration online via the uplink.in.gov portal. This should be done on or before the due date of the employer's first quarterly report. If the employer is unable to submit the application online, a completed SF 2837 form must accompany the employer's first quarterly contribution report.

Is it mandatory to disclose Social Security Numbers (SSNs) on the form?

Yes, the disclosure of SSNs is mandatory as per IC 4-1-8-1. The form cannot be processed without disclosing the required Social Security Numbers.

What happens if I fail to register or inaccurately complete the SF 2837 form?

Failure to timely register an account or to accurately complete the application and disclosure statement may result in civil penalties being assessed against the employer or the non-employer agent, as outlined in IC 22-4-11.5-9.

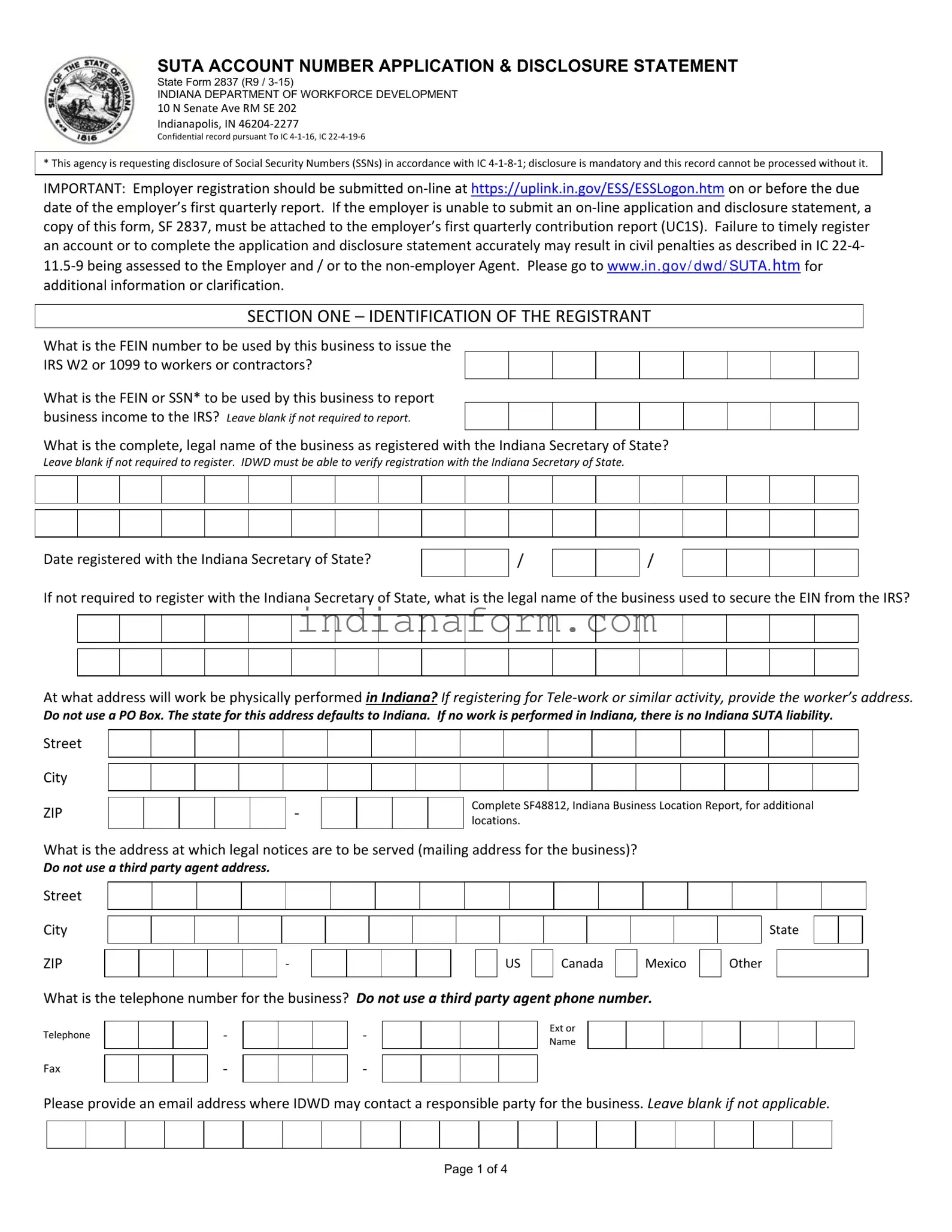

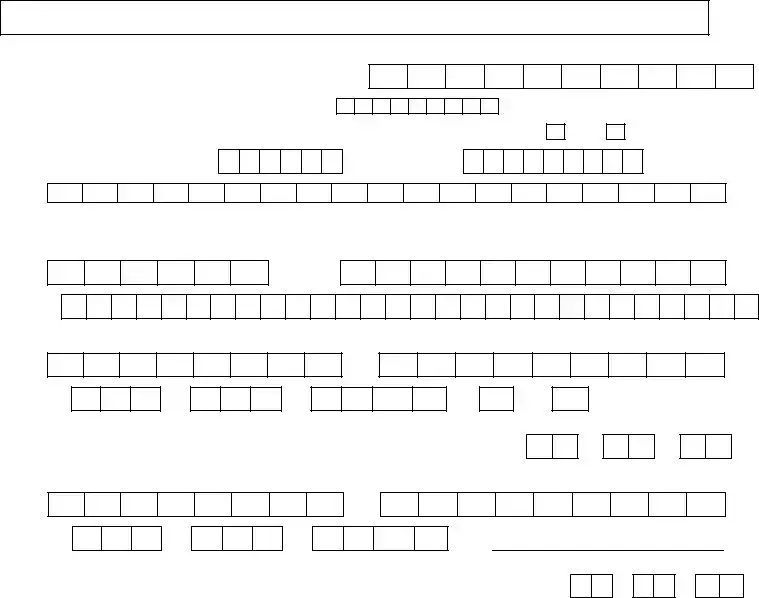

What type of information is required in Section One of the form?

Section One of the form requires detailed identification of the registrant, including the FEIN number to be used, the complete legal name of the business, the date registered with the Indiana Secretary of State (if applicable), addresses where work will be performed, and contact information.

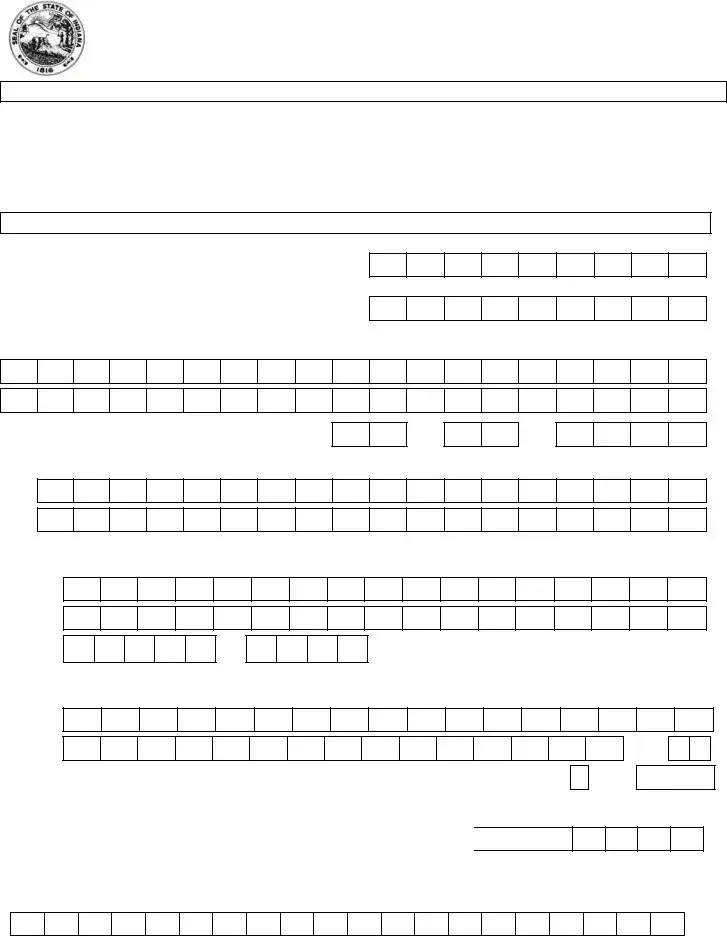

What is required for a business that is registering as a new entity with liability for payroll in Indiana?

A new business with Indiana payroll liability must indicate its type of entity (such as LLC, corporation, etc.), provide the date of its first payroll payment, and complete all relevant sections of the SF 2837 form to establish their account for State Unemployment Tax Act purposes.

What are the consequences of not accurately reporting a transfer of business assets?

Not disclosing the transfer of business assets, including workforce, is considered a material misrepresentation under the Act. It's crucial to accurately report any asset transfers to avoid penalties. Attached documentation supporting the type of transfer is required for evaluation.

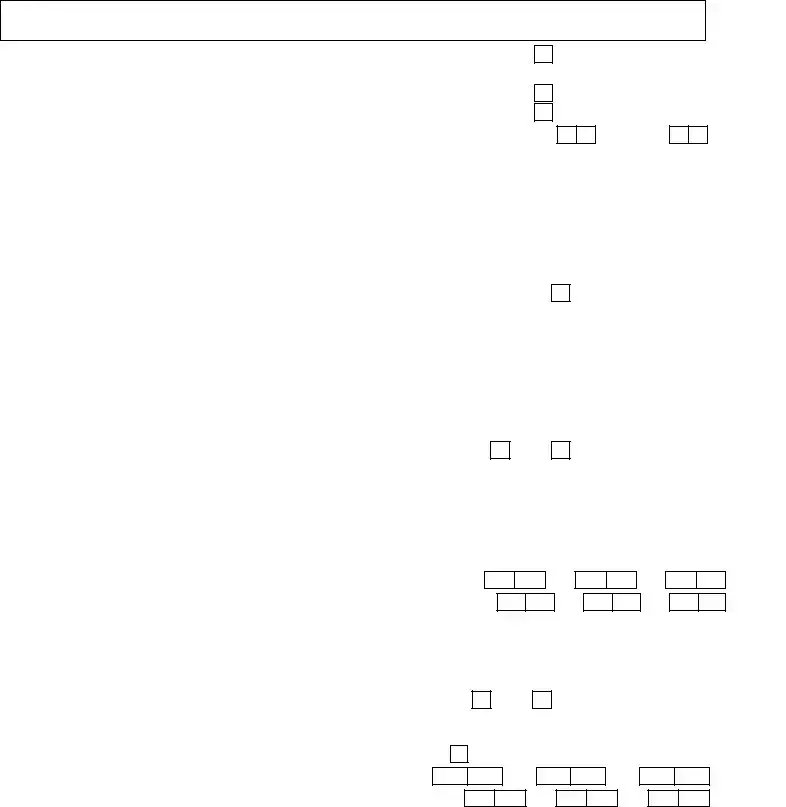

Is it possible to elect to make payments in lieu of contributions?

Yes, certain qualifying entities, like 501(c)(3) organizations, may elect to make payments in lieu of contributions. This election must be done by completing this form and SF 24321 within thirty-one days of becoming liable. However, businesses voluntarily electing to extend the Act are not eligible for this option.

Where should the completed SF 2837 form be sent?

Completed forms should be mailed to the IDWD – Employer Status Reports at 10 N Senate Ave Rm SE 202, Indianapolis, IN 46204-2277. Employers may also fax completed forms to 317-233-2706 or find additional contact information for specific questions or concerns online.