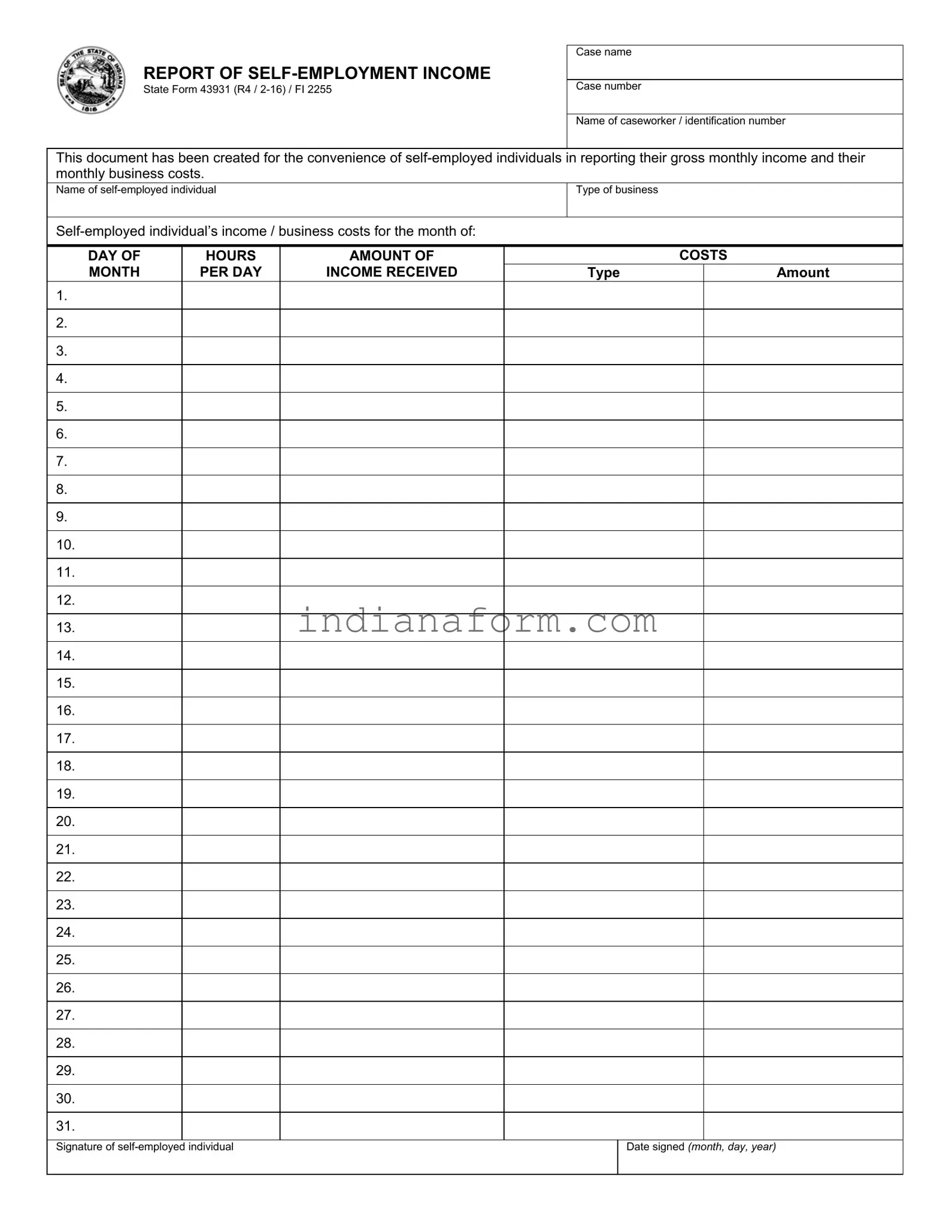

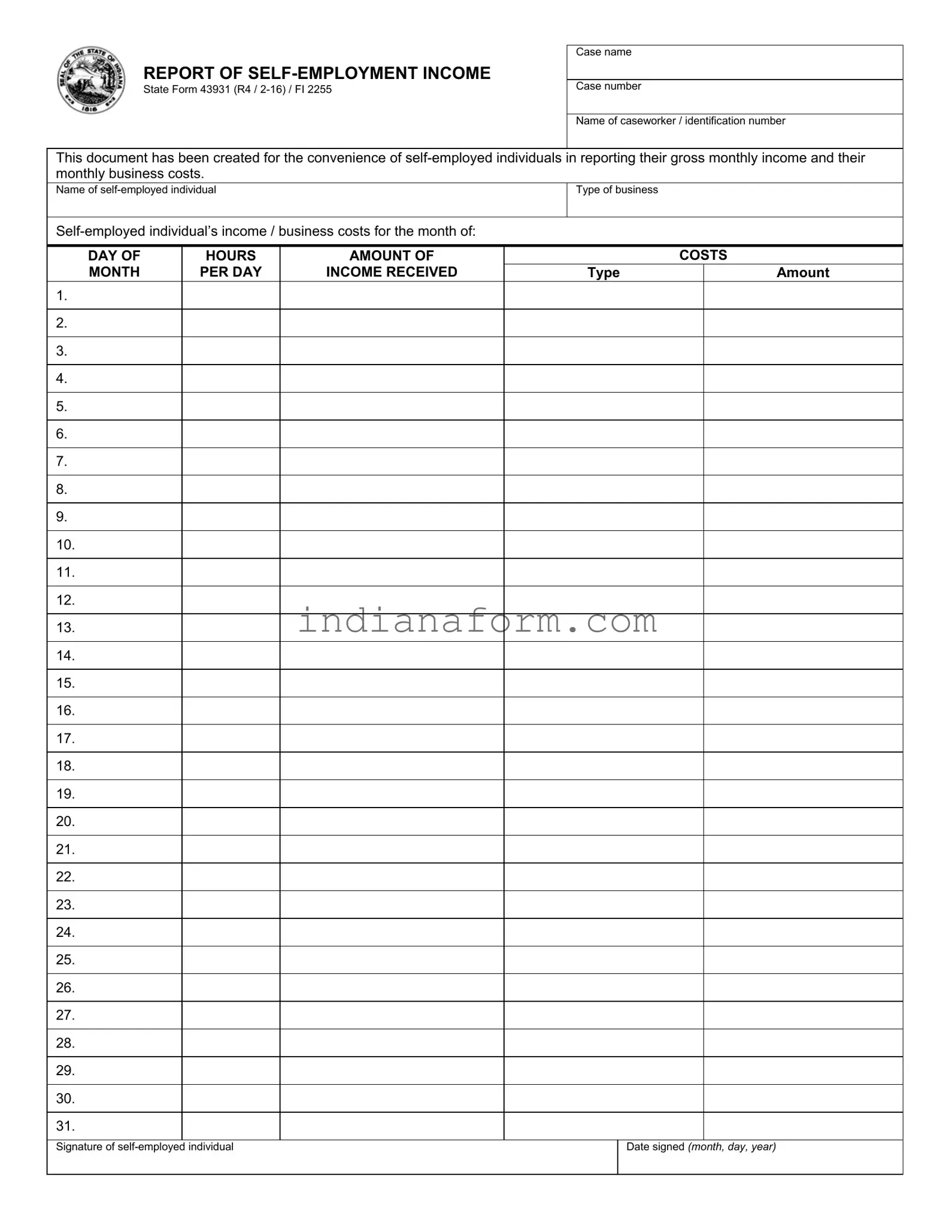

What is the purpose of the Indiana State Form 43931?

The Indiana State Form 43931, also known as the Report of Self-Employment Income, is designed specifically for self-employed individuals to report their gross monthly income and their monthly business costs conveniently. This form plays a crucial role in documenting and tracking an individual's self-employment earnings and expenditures for various purposes, including tax filing and applying for certain types of financial assistance or benefits that require proof of income.

Who needs to fill out the Indiana State Form 43931?

This form is intended for use by self-employed individuals. These are people who run their own businesses, including freelancers, independent contractors, and other solo entrepreneurs, who need to report their business income and costs to the state of Indiana for any official purpose.

What information is required on the Indiana State Form 43931?

The form requires several pieces of information, including the case name and number, the name and identification number of the caseworker, the name of the self-employed individual, and the type of business. Additionally, the self-employed individual must provide detailed information about their income and business costs for each day of the reported month, including the number of hours worked, the amount of income received, and the type and amount of costs incurred.

How often should the Indiana State Form 43931 be completed and submitted?

Since the form reports monthly income and expenses, it should be completed and submitted once every month. This regular submission ensures that the self-employed individual's financial records are up-to-date, facilitating any assessments or calculations requiring this information.

Where can I find the Indiana State Form 43931?

The form is typically available through the Indiana state government's official website or at local government offices that handle business registrations, tax filings, or benefit applications. It may also be provided by a caseworker if the form is needed for specific government programs or services.

Can I submit the Indiana State Form 43931 electronically?

The availability of electronic submission depends on the policies of the specific Indiana state department or agency requiring the form. Some departments may accept digital submissions via email or an online portal, while others might require a hard copy. Always check with the relevant department for their submission guidelines.

What happens if I do not submit the Indiana State Form 43931?

If the form is required for tax purposes, benefits eligibility, or any other official process, failing to submit it could lead to delays in processing your application, denial of benefits, penalties, or fines. It is important to submit the form as required to ensure compliance with state regulations and to maintain accurate records of your self-employment income and expenses.