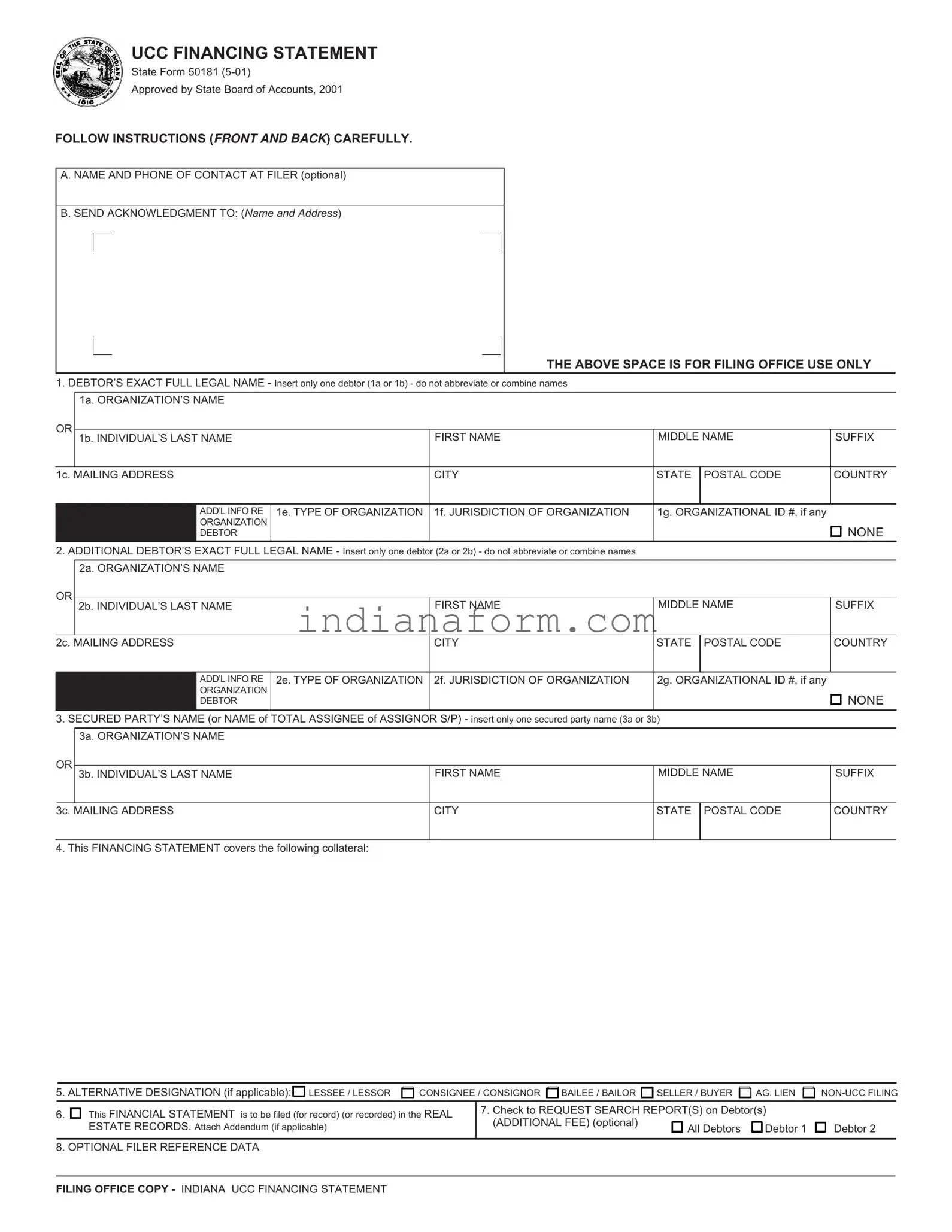

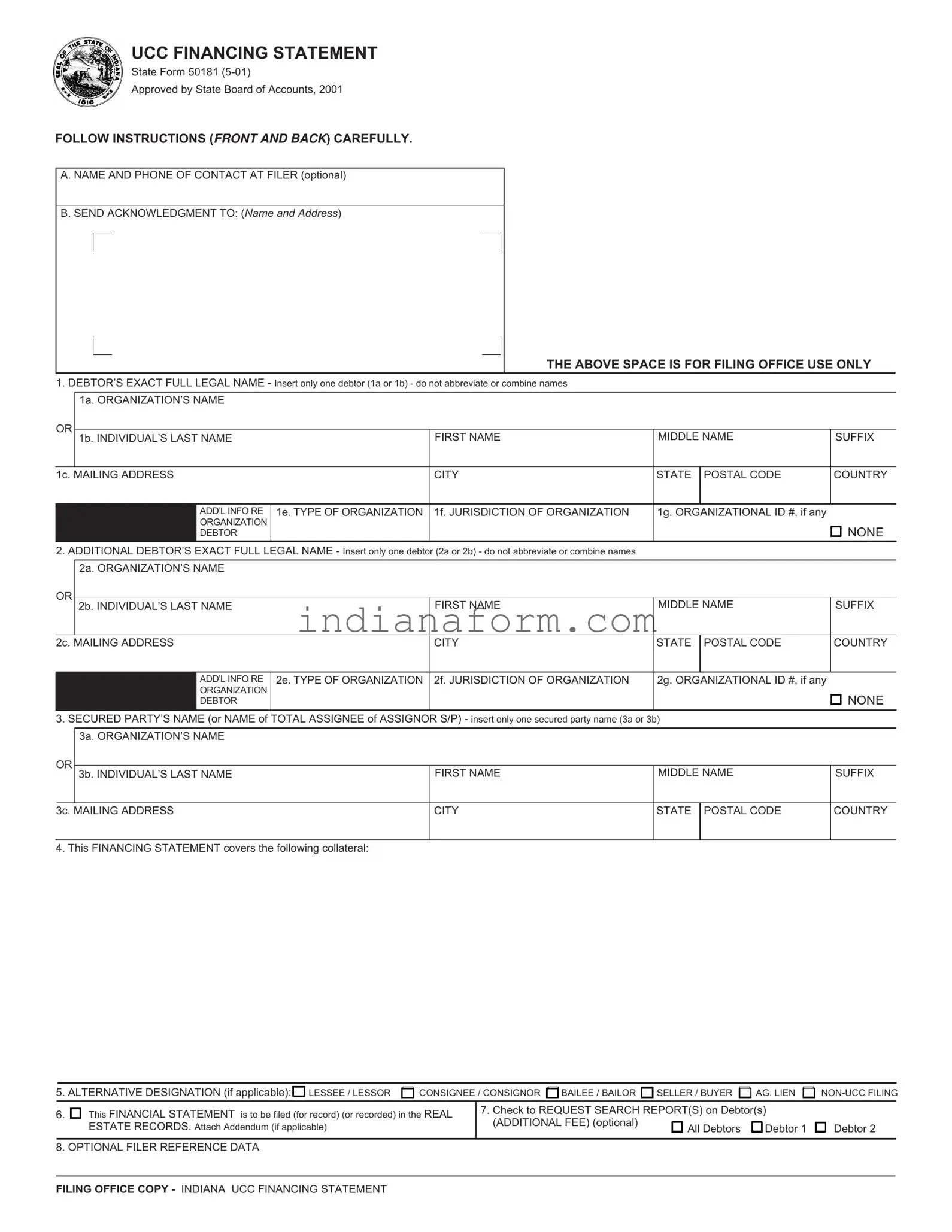

What is a UCC Financing Statement (Form 50181) in Indiana?

A UCC Financing Statement, specifically Form 50181 in Indiana, is a legal form used to declare a security interest in a debtor's personal property to the public. This form, when correctly filed, makes it possible for secured parties (lenders) to prioritize and enforce their security interests in the property outlined in the form, should the debtor default on their obligations.

Who needs to file Form 50181?

This form is typically filed by secured parties such as lenders or creditors who have extended credit that is secured by personal property. It can also be used by lessors, consignors, or sellers involved in certain types of transactions that are considered security interests under the Uniform Commercial Code (UCC).

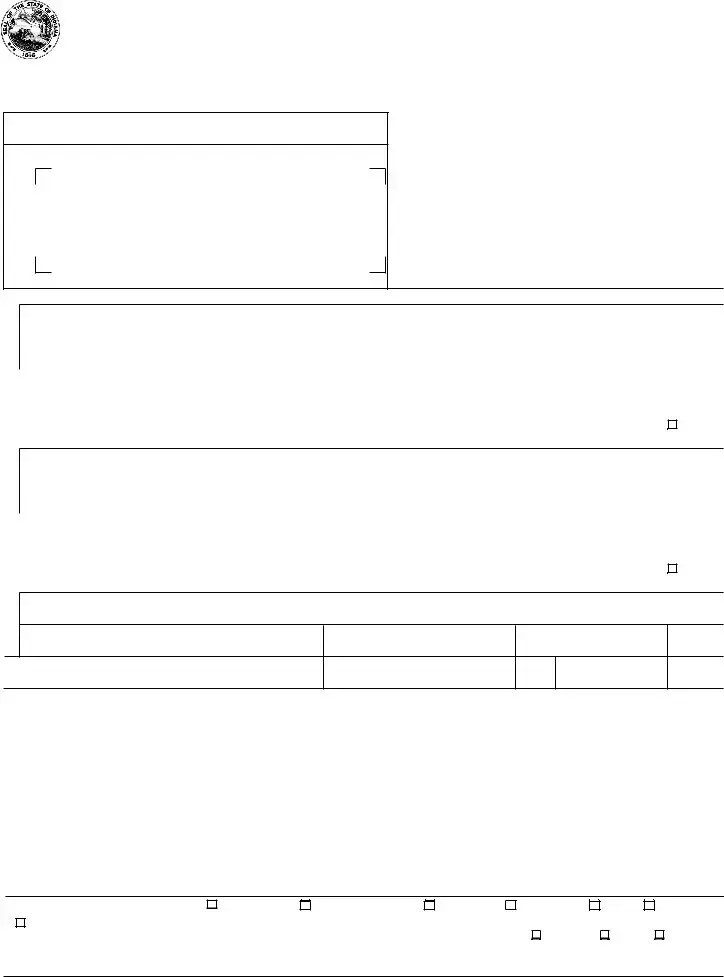

How does one correctly fill out the debtor's information on Form 50181?

When filling out the debtor's information on Form 50181, it's crucial to use the debtor's exact full legal name without abbreviations or aliases. For businesses (organizations), this includes the legal name as registered. For individuals, include the surname, first name, and all middle names. Providing an accurate and complete address is also mandatory.

What information is required for the secured party on the form?

The form requires the secured party's exact full legal name and mailing address. If the secured party is an organization, use the registered business name. For individuals, include the full name and address. If there's been a total assignment of the secured party's interest, the assignee's details should be included as well.

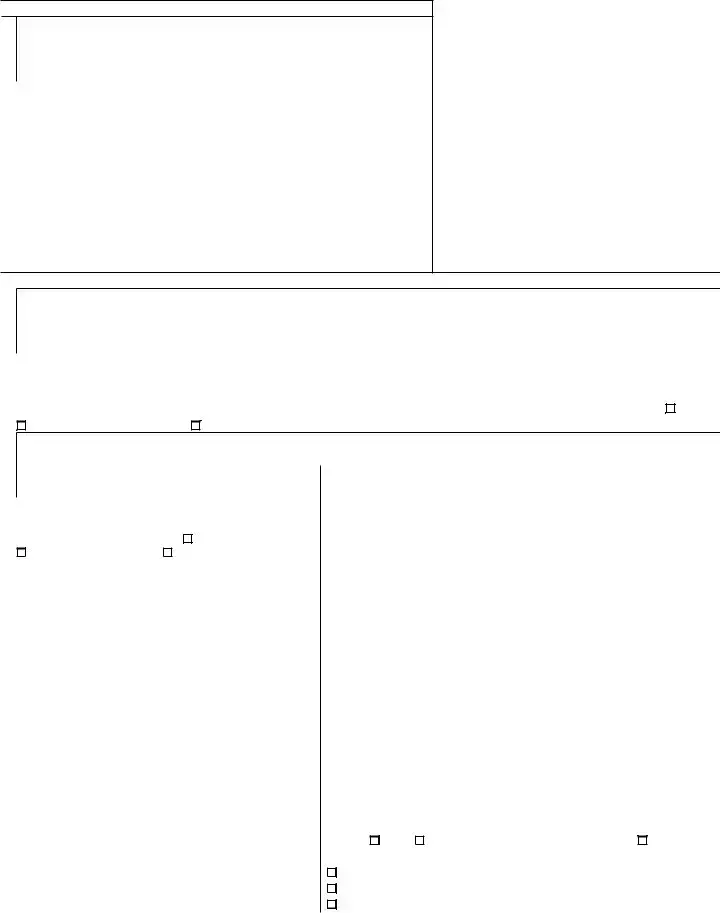

Can additional debtors or secured parties be added to Form 50181?

Yes, additional debtors or secured parties can be added. This is typically done by attaching an addendum to the form, following the initial entry instructions to ensure consistency and legal validity. Each additional party must be clearly identified along with their full legal name and address.

What happens if there is a mistake on the form?

Mistakes on Form 50181 can have significant legal implications, possibly affecting the enforceability of the secured party's interest. To correct errors, an amendment form (usually referred to as a UCC-3 form) has to be filed, detailing the correct information and referencing the initial filing.

Is there a fee to file the Indiana State Form 50181?

Yes, there is a filing fee associated with Form 50181. The base fee covers the first two pages of the form. There is an additional fee for forms that exceed two pages and for certain types of transactions such as public finance or manufactured home transactions. It's advisable to check the latest fees with the Indiana filing office or their official website.

How does one obtain an acknowledgment of the filing?

To receive an acknowledgment of the filing, complete section B of Form 50181 with the name and address to which the acknowledgment should be sent. Depending on the filing office's practices, you might also need to send an acknowledgment copy. Always check the specific instructions provided by the filing office.