State 38337 Form in PDF

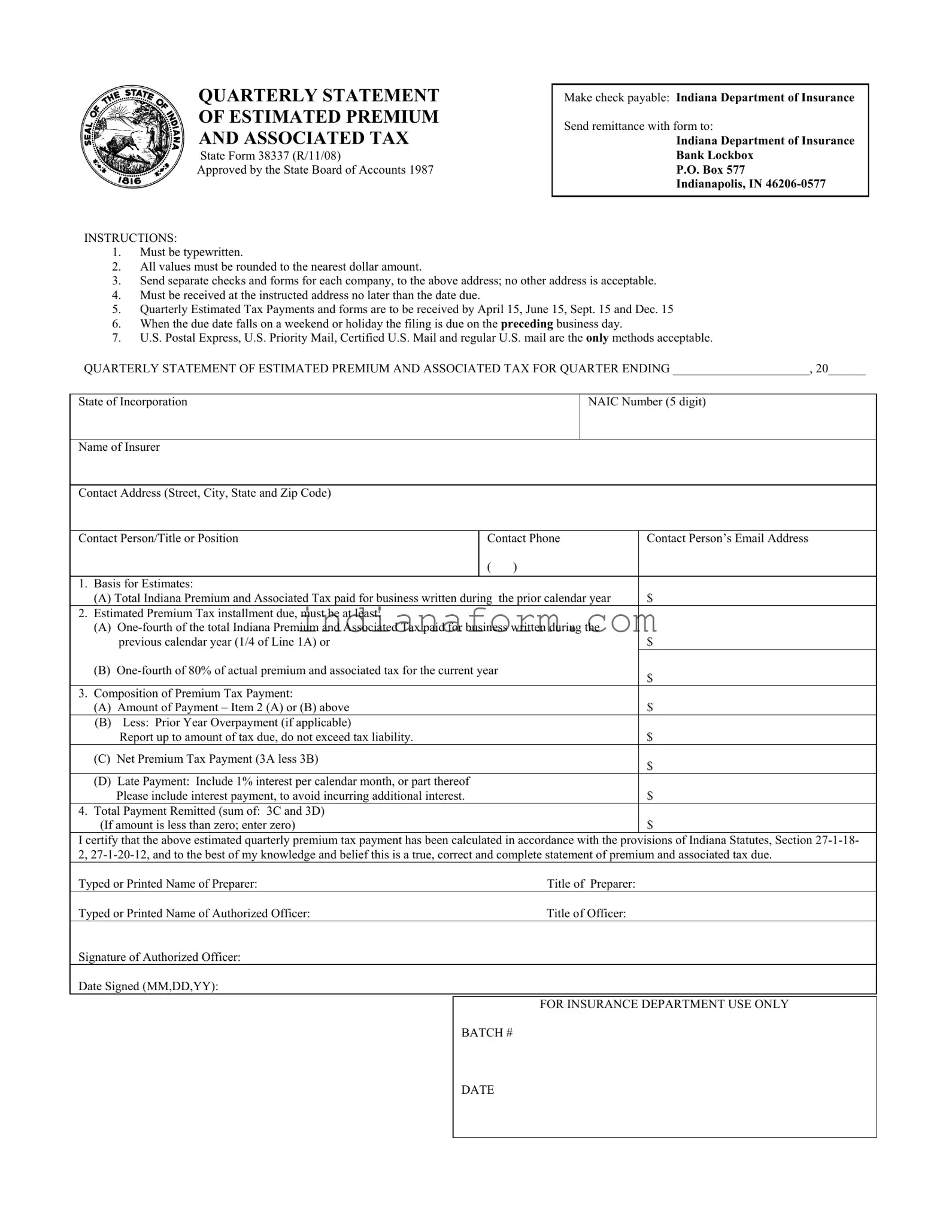

The State Form 38337 is a mandated document for reporting Quarterly Statement of Estimated Premium and Associated Tax, approved by the State Board of Accounts in 1987 for use within the Indiana Department of Insurance. This form facilitates the calculated remittance of estimated premium taxes and associated amounts due, ensuring that insurance companies comply with state tax obligations on a quarterly basis. Instructions include requirements for typewritten submissions, rounding values to the nearest dollar, and specific mailing instructions to maintain accurate and timely tax payments.

Fill Out Your Document Online

State 38337 Form in PDF

Fill Out Your Document Online

Fill Out Your Document Online

or

⇓ State 38337 PDF Form

Don’t stop halfway through your form

Edit your State 38337 online and get it downloaded.