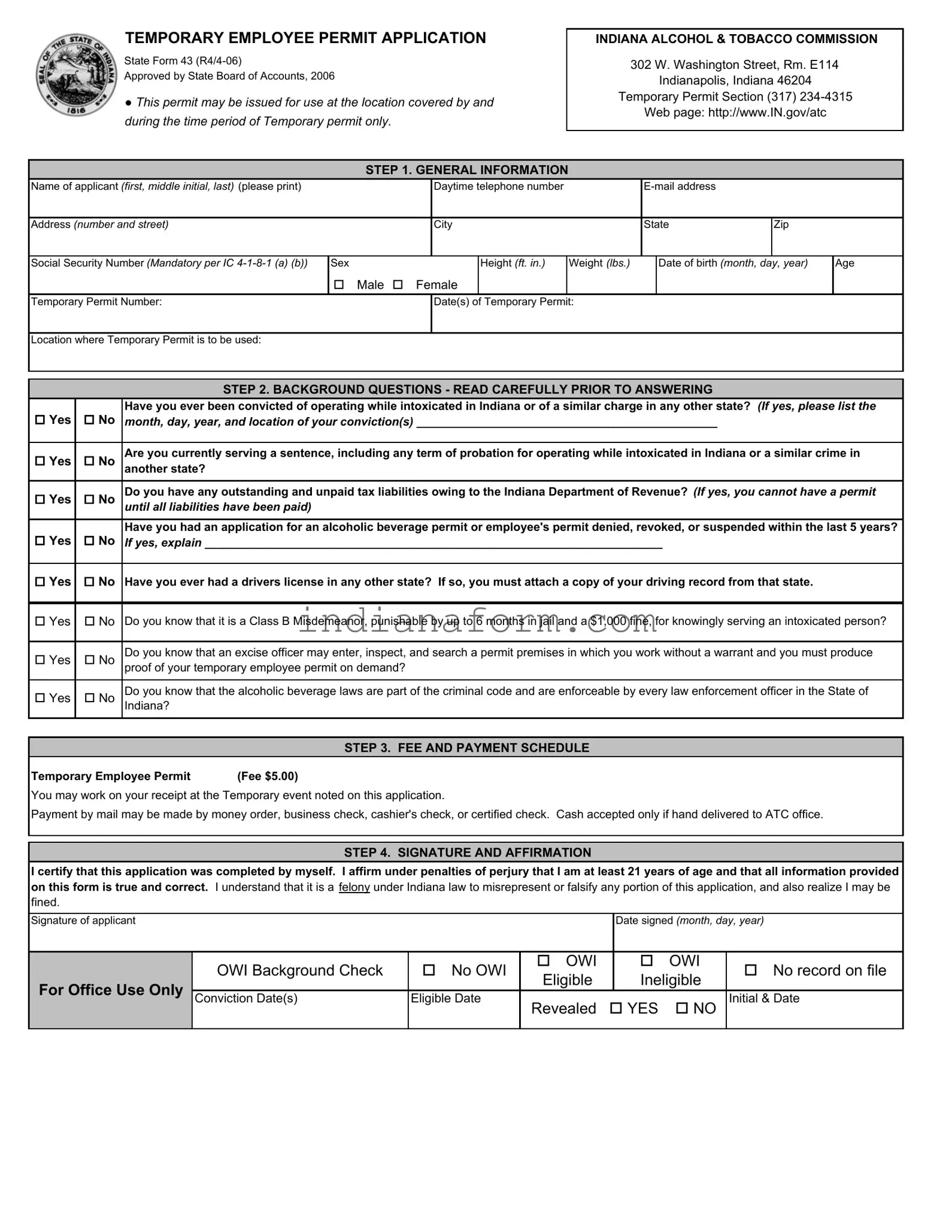

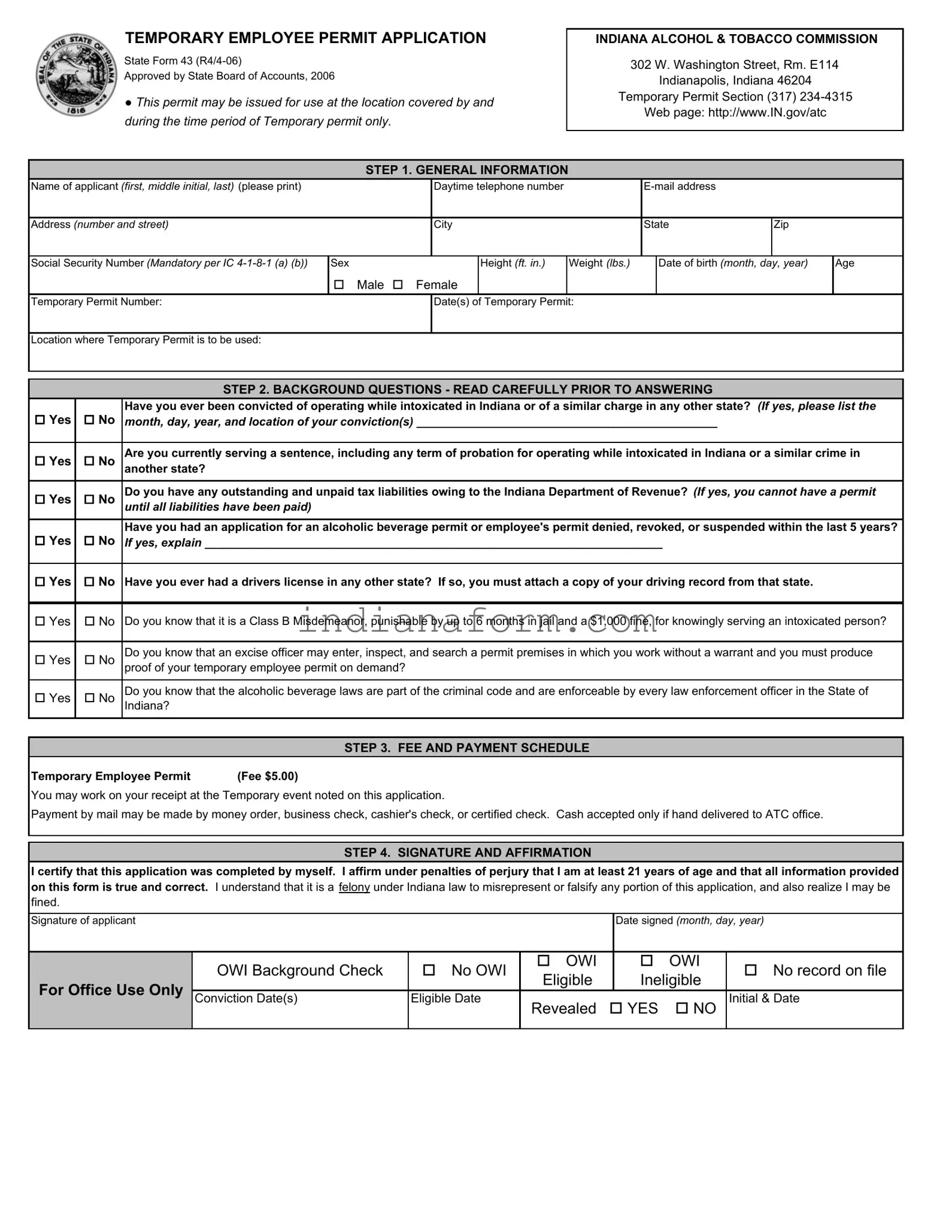

What is the State Form 43?

State Form 43 is an application form used in Indiana for individuals seeking a Temporary Employee Permit to work at events or establishments that serve alcoholic beverages. This permit is necessary for those who wish to be employed in positions that involve the sale or distribution of alcohol in Indiana, specifically for temporary events.

Who needs to fill out State Form 43?

Any individual who aims to work in a temporary capacity at an event or venue in Indiana where alcohol is served is required to fill out State Form 43. This includes jobs such as bartending, serving, or any other role that directly handles alcohol.

What information is needed to complete State Form 43?

To complete the form, applicants must provide general information such as their full name, contact details, social security number, physical attributes, and details regarding their driving and criminal history. This information is used to assess their eligibility for a Temporary Employee Permit.

Is there a fee associated with the Temporary Employee Permit Application?

Yes, there is a $5.00 fee required when applying for a Temporary Employee Permit via State Form 43. This fee can be paid through various methods including money order, business check, cashier’s check, or certified check, and cash is accepted only if the payment is made in person at the ATC office.

What are the background questions on State Form 43?

The form includes questions related to the applicant's history of operating while intoxicated, any outstanding and unpaid tax liabilities to the Indiana Department of Revenue, and any past denials, revocations, or suspensions of alcoholic beverage permits or employee's permits. These questions help determine an applicant's eligibility for a Temporary Employee Permit.

What happens if you have been convicted of operating while intoxicated?

If you have been convicted of operating while intoxicated, either in Indiana or any other state, you must disclose this information on the form. This does not automatically disqualify you, but the details of your conviction will be reviewed as part of the eligibility process for obtaining a Temporary Employee Permit.

Can you work while your Temporary Employee Permit application is being processed?

Yes, applicants may work at the temporary event noted on their application upon receipt of their application fee. This allows individuals to begin employment while their application for a Temporary Employee Permit is under review.

What is the significance of knowing that serving an intoxicated person is a misdemeanor?

Acknowledgment that knowingly serving an intoxicated person constitutes a Class B Misdemeanor reinforces the responsibility of individuals servicing alcohol. This knowledge is crucial in promoting safe and responsible alcohol service, aligning with Indiana’s efforts to prevent alcohol-related incidents.

How does one affirm the application?

The applicant must sign the form, affirming under penalties of perjury that they are at least 21 years of age and that all information provided is true and correct. Falsifying information on the application is a felony under Indiana law, highlighting the importance of honesty in the application process.

What steps should be taken if additional information is needed after filling out the form?

If an applicant needs to provide additional information or clarify any details after submitting State Form 43, they should contact the Indiana Alcohol & Tobacco Commission directly through the contact information provided on the form. This ensures any queries or concerns can be promptly addressed, facilitating the processing of the application.