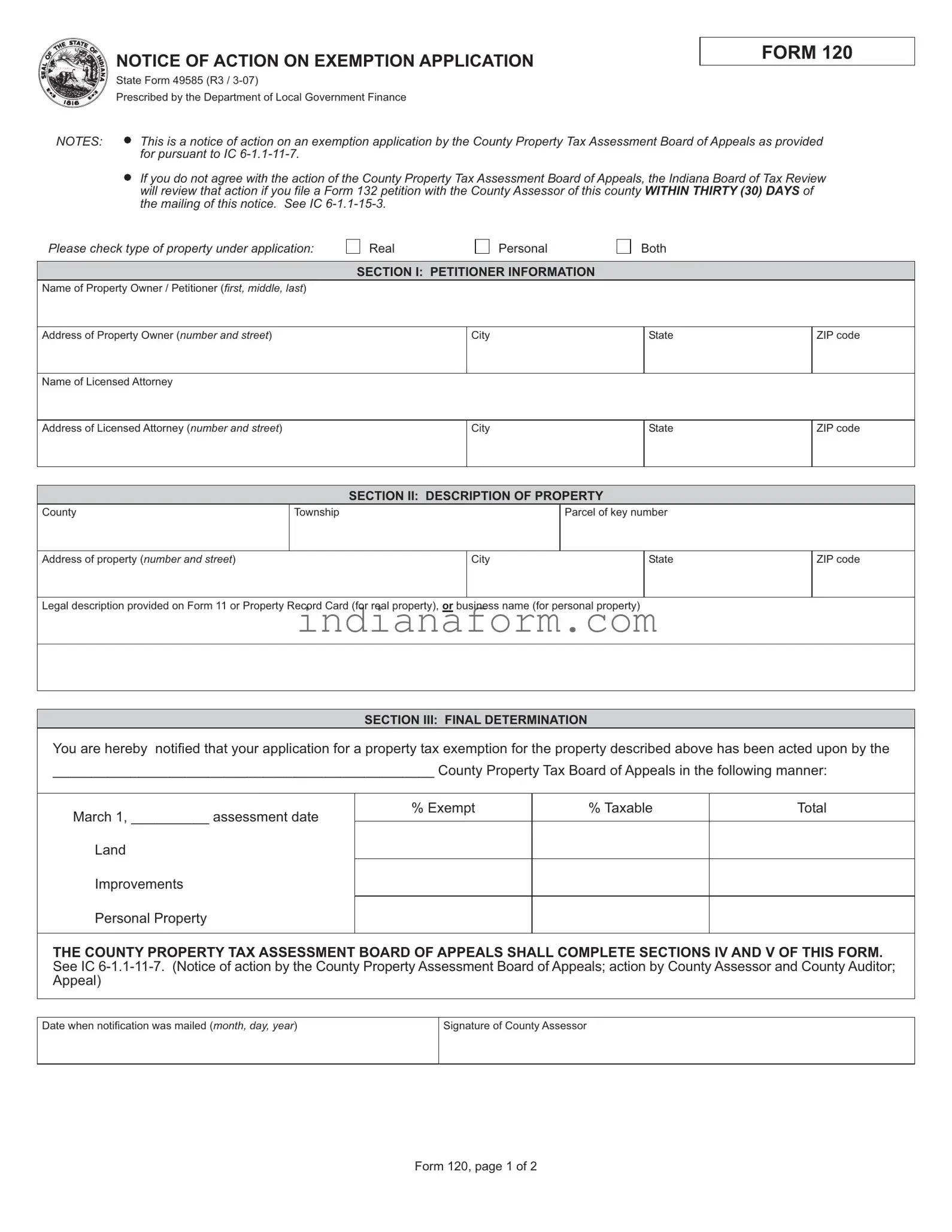

What is the State Form 49585?

State Form 49585, also known as the Notice of Action on Exemption Application, is a document issued by the County Property Tax Assessment Board of Appeals. This form serves as a notification regarding the board's decision on an application for property tax exemption in Indiana. It is used for both real and personal property tax exemption applications.

Who should receive the State Form 49585?

The form is mailed to property owners or petitioners who have applied for a property tax exemption. If a petitioner has a licensed attorney, a copy may also be sent to the attorney's address. It provides the applicants with the board's decision on their exemption request.

What actions can I take if I disagree with the decision?

If you disagree with the decision of the County Property Tax Assessment Board of Appeals, you have the right to appeal. An appeal can be filed by submitting a Form 132 petition to the County Assessor within 30 days from the mailing date of the notice.

What information is included in the State Form 49585?

The form includes the petitioner's information, a description of the property in question, and the final determination of the exemption application. The determination section will indicate the percentage of the property that is exempt and taxable, along with the decision on land improvements and personal property if applicable.

How is the determination made by the Board detailed in the form?

The determination made by the County Property Tax Assessment Board of Appeals is detailed in the form, including reasons for the decision. This section may cite applicable statutes, regulations, or case law that support the determination.

What sections of the State Form 49585 must be completed by the County Property Tax Assessment Board of Appeals?

Sections IV and V of the form must be completed by the County Property Tax Assessment Board of Appeals. These sections include the determination and reason for the decision, along with the signatures and dates signed by the board's member and secretary.

What does it mean if my property is categorized as % Exempt and % Taxable?

The categories of % Exempt and % Taxable in the final determination indicate the portions of your property that are exempt from property taxes and those that are subject to taxation. If your property is partially exempt, this will reflect how much of your property's value is taxable and how much is exempt from property taxes.

Is there a deadline for filing an appeal if I disagree with the exemption decision?

Yes, there is a strict deadline for filing an appeal. You must file a Form 132 petition with the County Assessor of your county within 30 days of the mailing of the State Form 49585. It is important to act quickly if you wish to appeal the decision.