What is the UC 5A form used for?

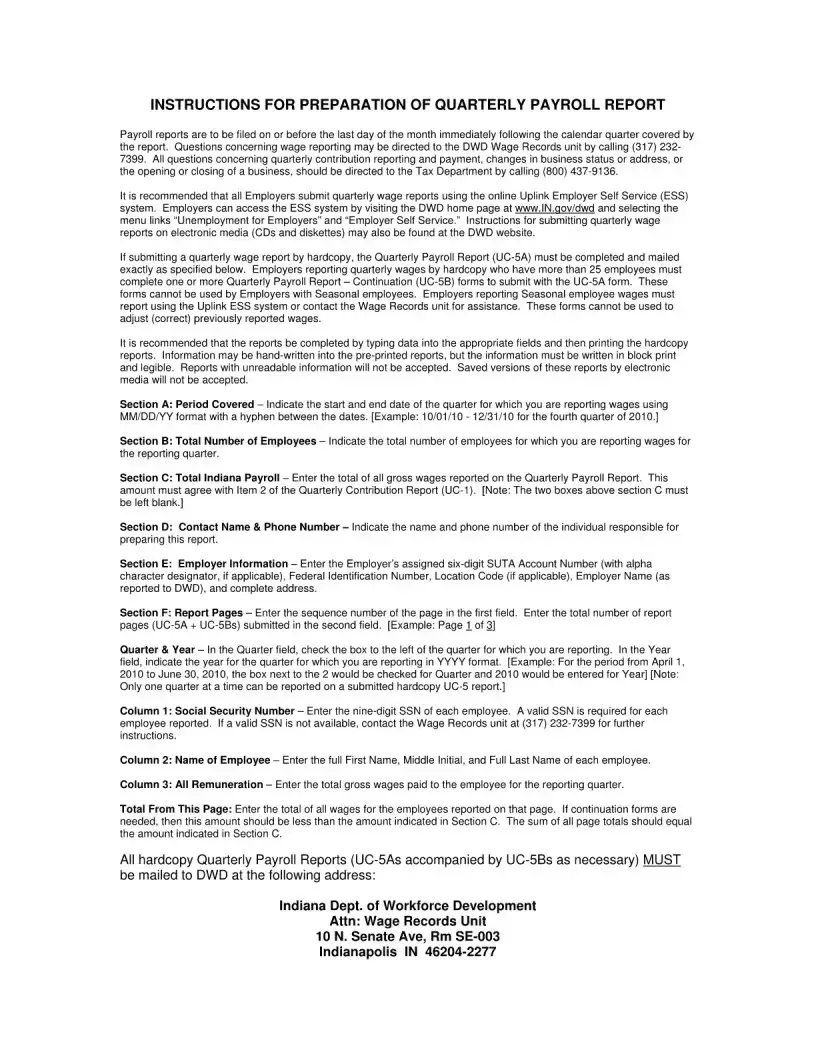

The UC 5A form is primarily employed byEmployers to report their quarterly unemployment compensation. This includes detailing wages paid to employees, unemployment contributions due, and any other pertinent information related to unemployment insurance for the reporting period.

Who is required to fill out the UC 5A form?

Any employer who has employees and is subject to state unemployment tax laws is required to complete and submit the UC 5A form each quarter. This ensures compliance with state regulations concerning unemployment insurance reporting.

Where can I obtain a UC 5A form?

The UC 5A form is typically available through the state's department of labor or unemployment insurance office website. Employers can download the form as a PDF, fill it out digitally, or print it for manual completion. Some states may also offer the option to submit the form electronically through their websites.

When is the UC 5A form due?

The due date for the UC 5A form varies by state but generally falls within a month following the end of each quarter. To avoid penalties, it is imperative to submit the form and any payments due by the specified deadline of your state.

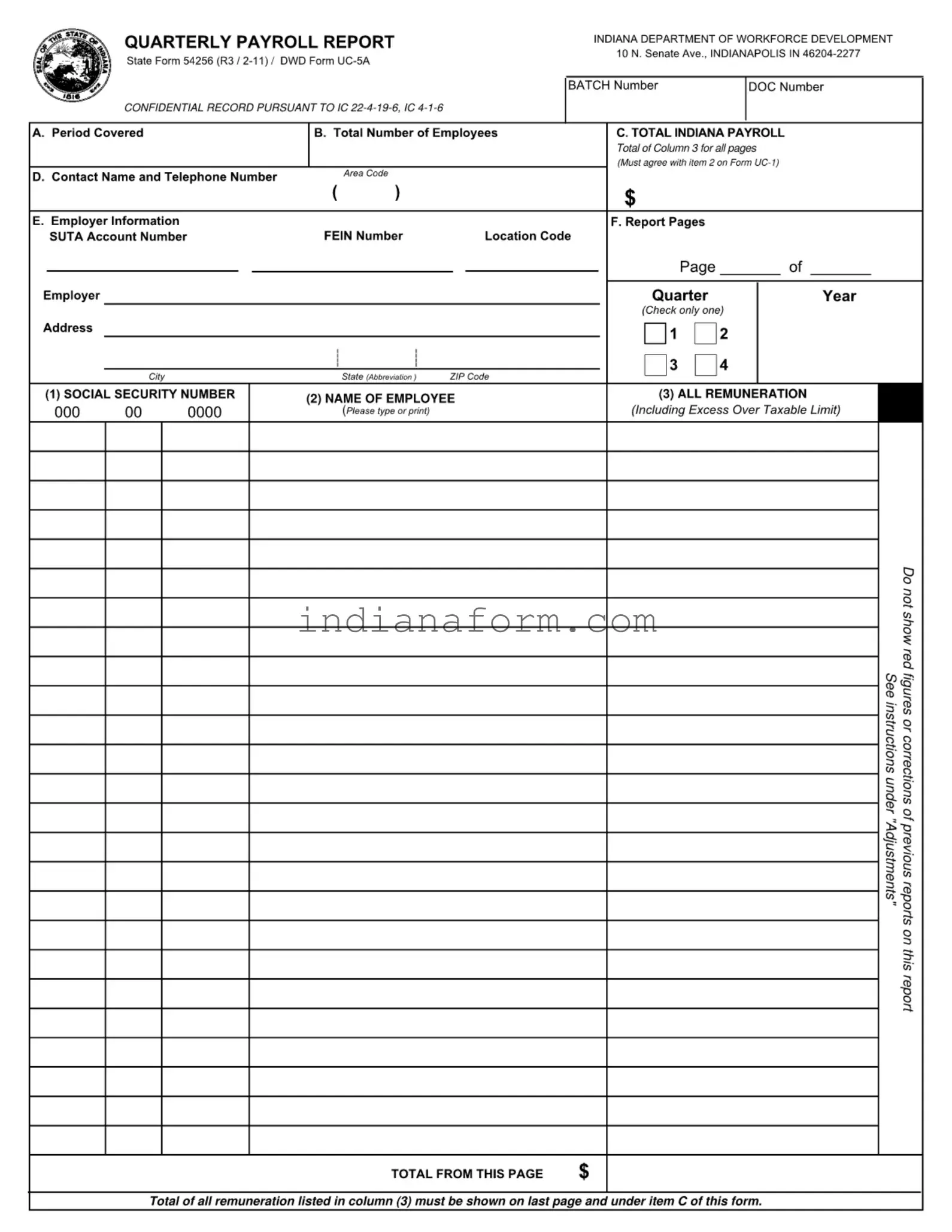

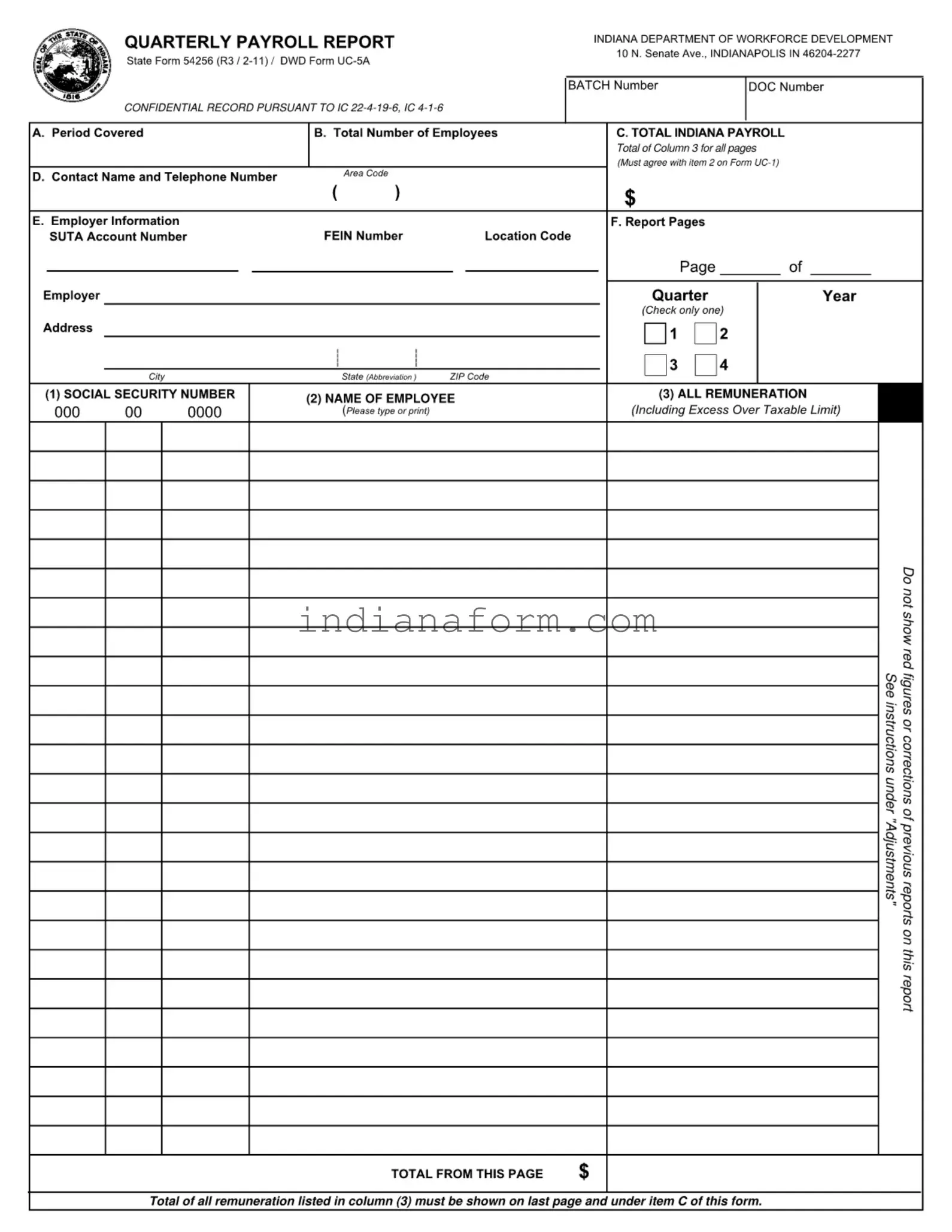

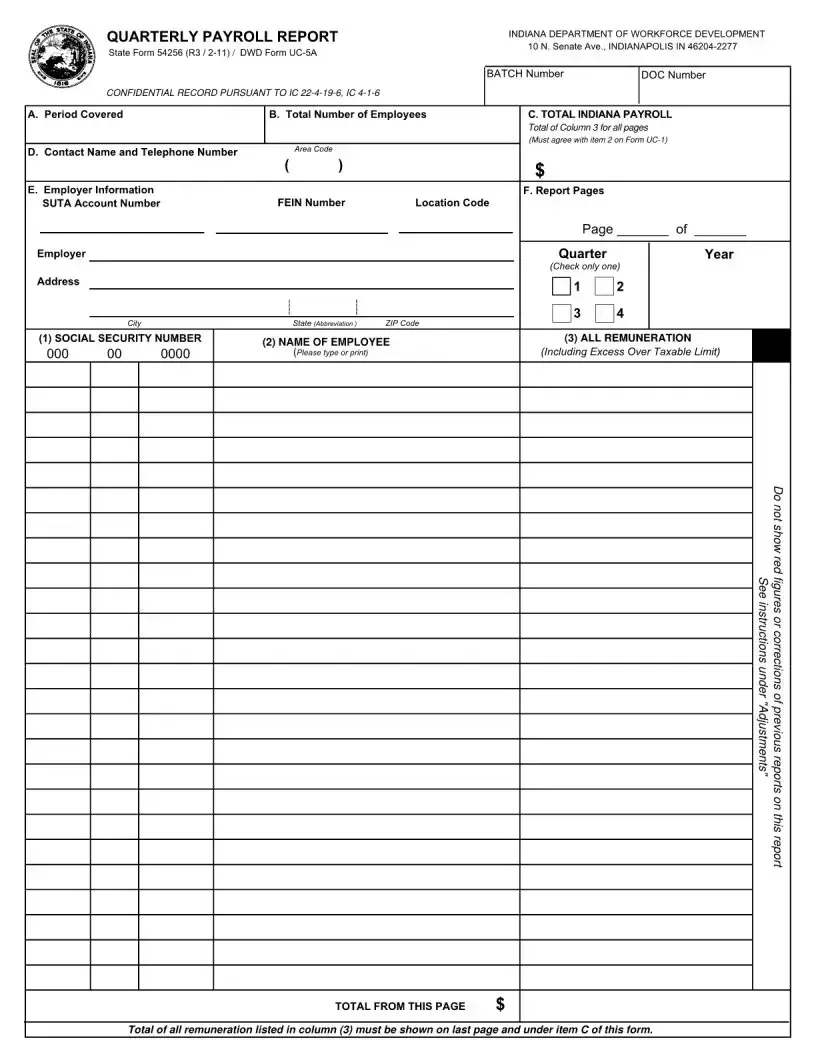

What information is needed to complete the UC 5A form?

To fill out the UC 5A form accurately, employers need to gather information including the total wages paid to employees during the quarter, the number of employees, tax rates, and any unemployment insurance contributions made. Additionally, employer identification numbers and contact information are required for identification and communication purposes.

Can the UC 5A form be corrected after submission?

Yes, if errors are found after submission, the UC 5A form can generally be corrected. Employers should contact their state's unemployment insurance office for guidance on how to submit a corrected form. It's crucial to address errors promptly to ensure accurate record-keeping and compliance.

What are the penalties for failing to submit the UC 5A form?

Failing to submit the UC 5A form by the due date can result in penalties, including fines and interest on late payments. Continual non-compliance may lead to further legal actions and increased penalties. The specific consequences depend on state regulations.

Can I submit the UC 5A form online?

Many states offer the option to submit the UC 5A form and accompanying payments online through their department of labor or unemployment insurance office websites. Online submission can simplify the process and ensure timely filing.

Is there assistance available for filling out the UC 5A form?

Yes, assistance for completing the UC 5A form is typically available. Employers can seek help from their state's unemployment insurance office, which may offer guides, helplines, or in-person assistance to navigate the form and ensure accurate completion.