W2 Bob Evans Indianapolis Form in PDF

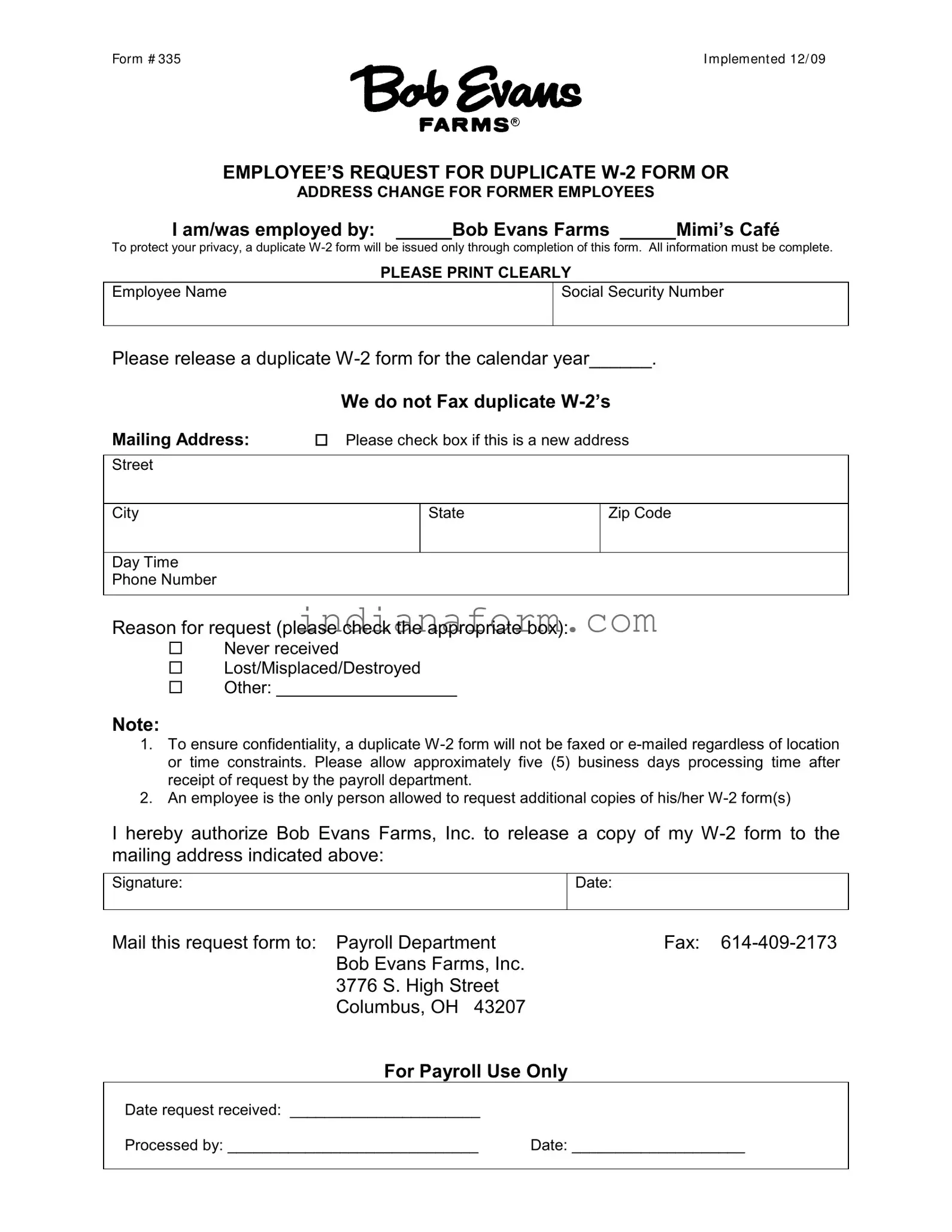

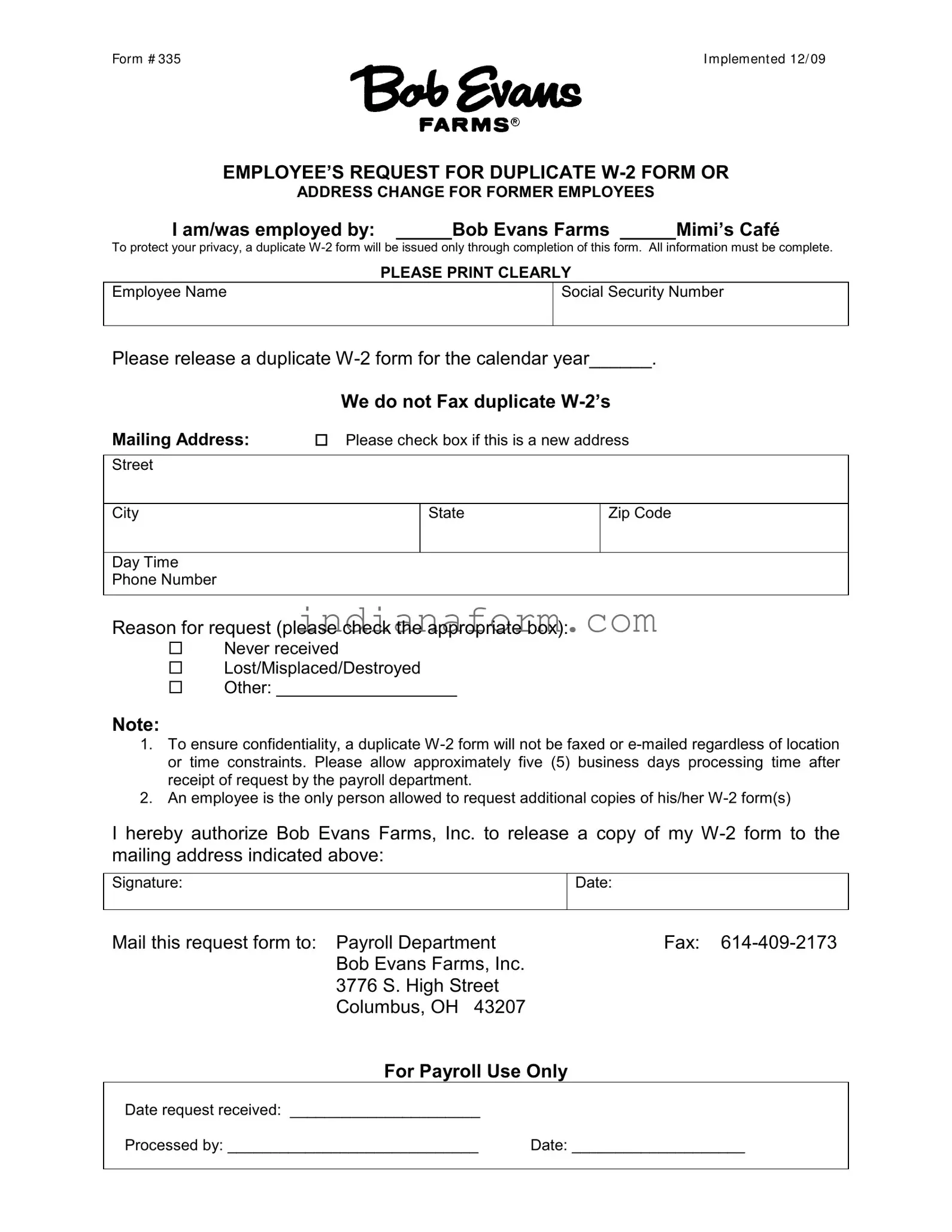

The W2 Bob Evans Indianapolis form, officially known as Form # 335, is designed for current or former employees who need to request a duplicate W-2 form or have their address updated for the sole purpose of receiving this tax document. Implemented on December 2009, it requires detailed information to protect the privacy of the requestor, ensuring that duplicate W-2s are issued securely and accurately. The form clearly stipulates that all requests must be in writing, highlighting the company’s commitment to confidentiality and the prevention of unauthorized access to sensitive employee information.

Fill Out Your Document Online

W2 Bob Evans Indianapolis Form in PDF

Fill Out Your Document Online

Fill Out Your Document Online

or

⇓ W2 Bob Evans Indianapolis PDF Form

Don’t stop halfway through your form

Edit your W2 Bob Evans Indianapolis online and get it downloaded.