What is the Indiana State 50504 form?

The Indiana State 50504 form is a document designed by the Indiana Department of Revenue. It's primarily used by individuals or entities to report certain types of transactions or financial activities to the state authorities. The specifics of what needs to be reported can vary, so it's important to check the latest guidelines when preparing to fill out this form.

Who needs to fill out the Indiana State 50504 form?

This form is required for individuals or businesses involved in specific transactions that fall under the reporting requirements set by the Indiana Department of Revenue. If you're unsure whether your transaction requires reporting via the 50504 form, consulting with a tax professional or the department's guidelines is advisable.

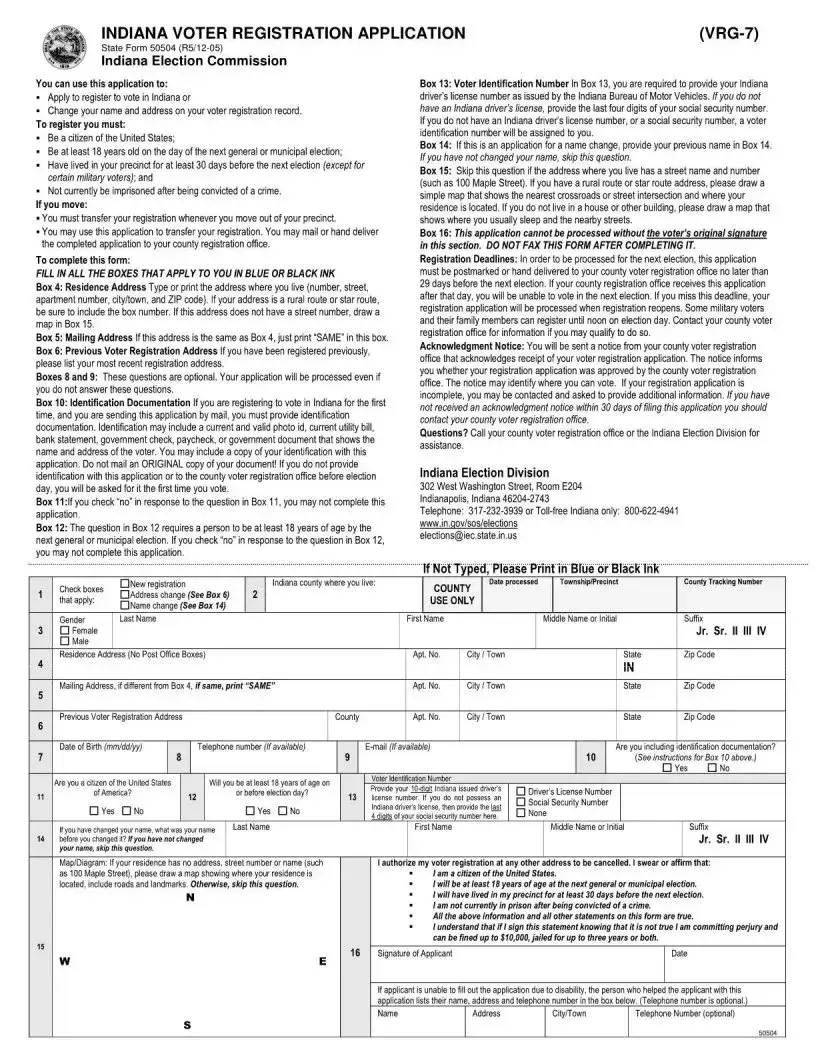

Where can I find the Indiana State 50504 form?

The 50504 form is available on the Indiana Department of Revenue's official website. It can be downloaded in a printable format. Make sure to get the form from a reliable source to ensure you have the most current version.

Is there a deadline for submitting the Indiana State 50504 form?

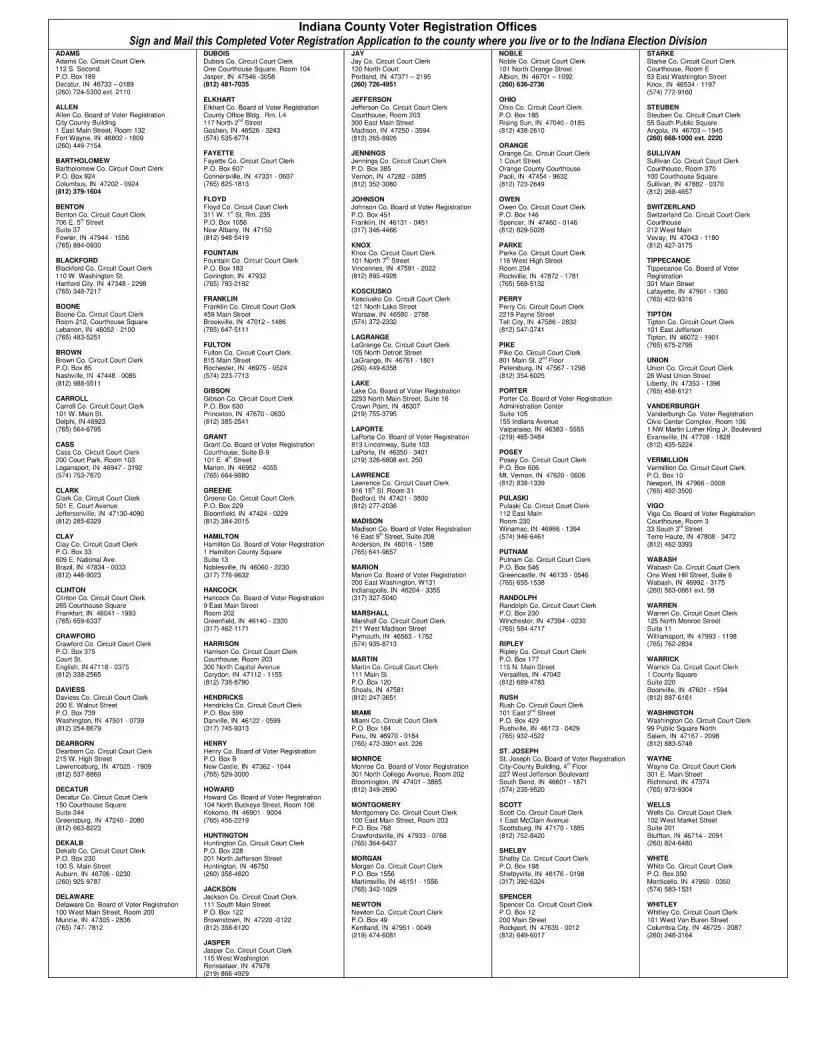

Yes, there typically is a deadline by which the form must be submitted to the Indiana Department of Revenue. The specific due date can vary depending on the reporting requirements. To avoid penalties, it's important to check the current year's deadline and submit the form on time.

Can I submit the Indiana State 50504 form online?

Whether the 50504 form can be submitted online depends on the current capabilities of the Indiana Department of Revenue's electronic filing systems. It's advisable to check their official website for the most up-to-date information on online submission options.

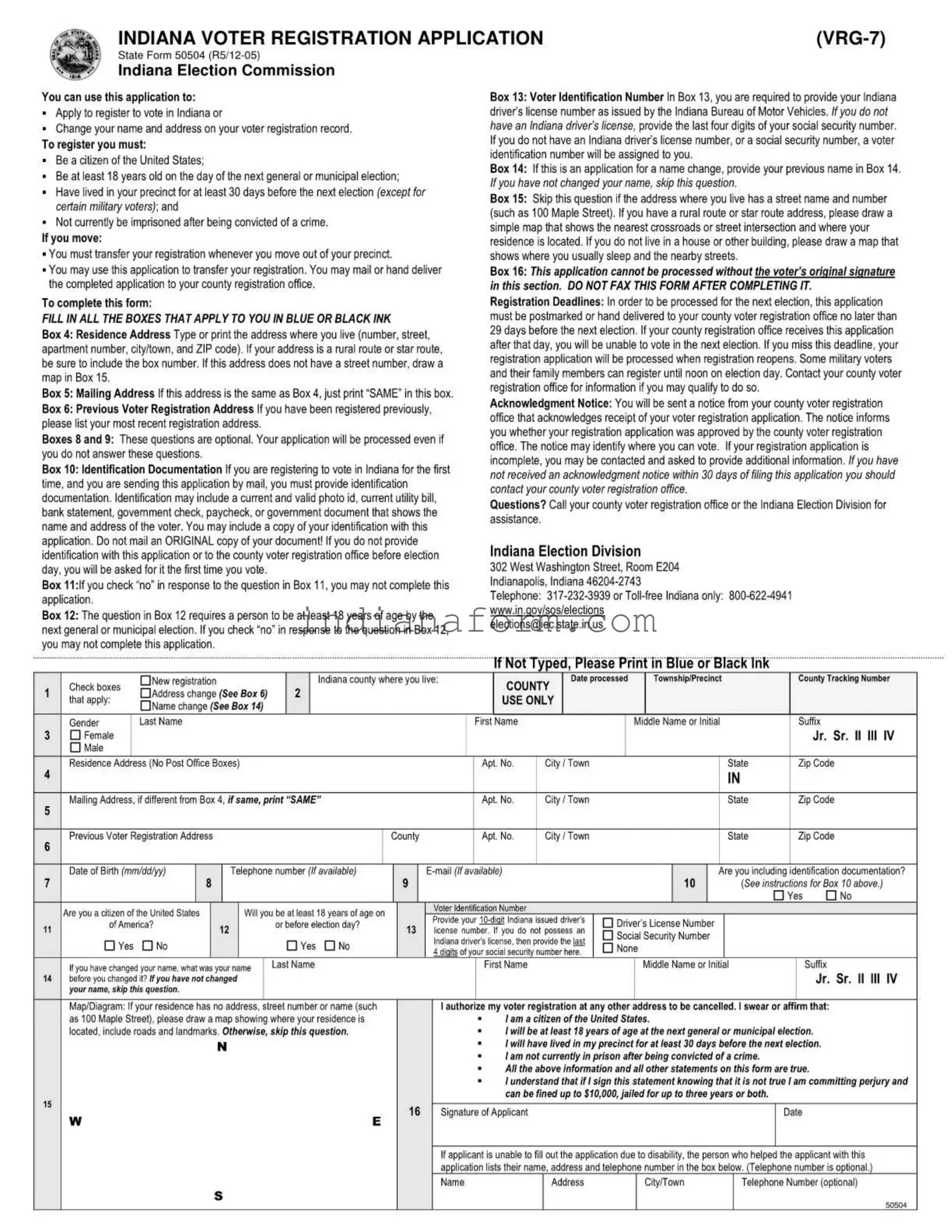

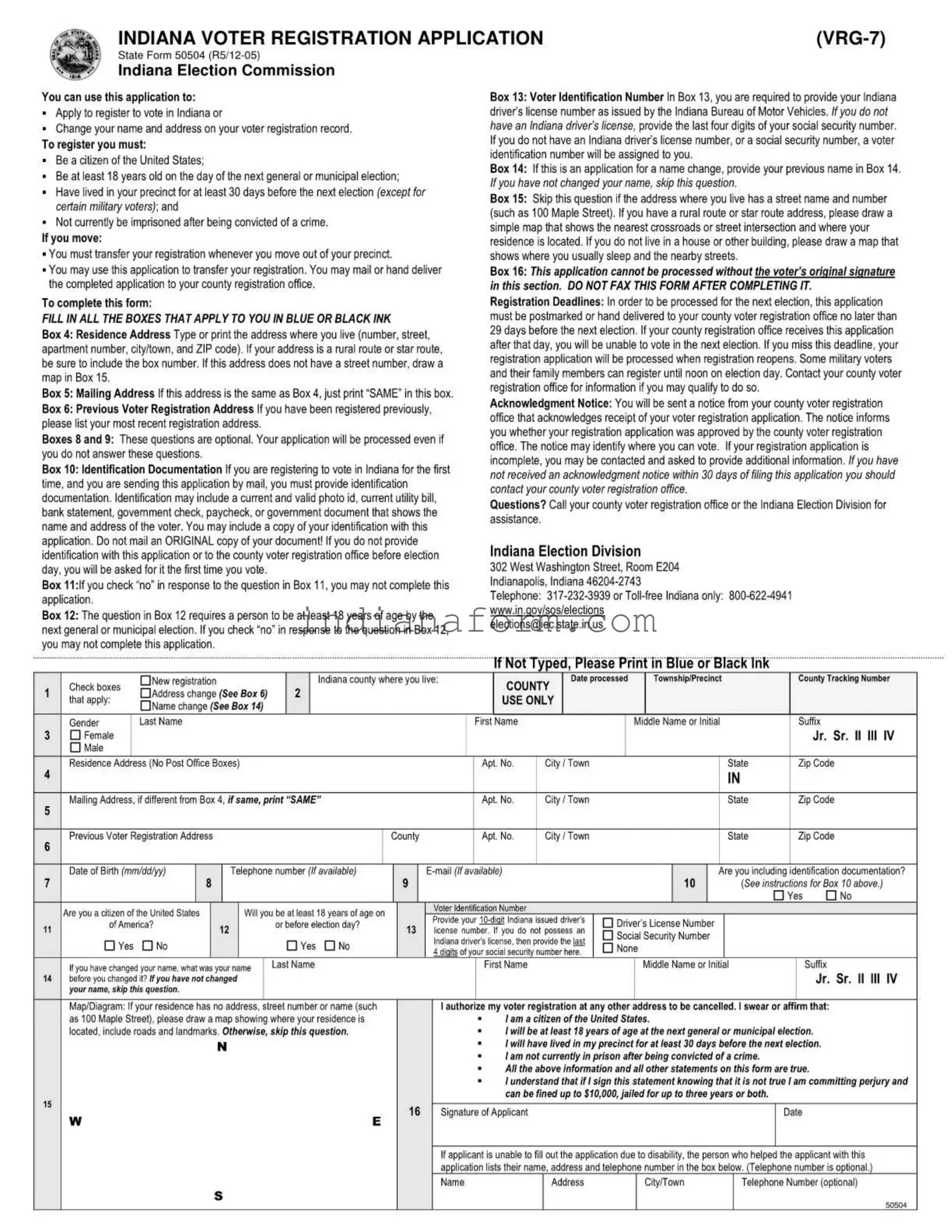

What kind of information do I need to provide on the Indiana State 50504 form?

The form requires detailed information about the transaction or financial activity being reported. This typically includes identification details for both the reporting entity and any other parties involved, the nature of the transaction, dates, and financial amounts. Ensure all information is accurate and complete to facilitate proper processing.

Are there penalties for not submitting the Indiana State 50504 form?

Failure to submit the form when required can lead to penalties. These could include fines or interest charges on any amounts that were not properly reported. It's crucial to comply with reporting requirements to avoid these consequences.

Can I get help filling out the Indiana State 50504 form?

If you're unsure how to complete the form, there are several resources available. You may consult a tax professional, reach out to the Indiana Department of Revenue directly, or seek guidance from financial advisors who are familiar with state reporting requirements.

What should I do after submitting the form?

After submitting the Indiana State 50504 form, it's recommended to keep a copy of the completed form and any submission receipts or confirmations. This documentation will be important if you need to reference the reported information later or if there are any questions about your submission.